The CommBank Neo is an innovative credit card that offers a simple and transparent way to manage your payments — interest-free, with no late fees and no surprises. If you are interested in applying, follow this step-by-step guide to understand the application process, eligibility requirements, and what to expect after approval.

Neo Card

Anúncios

AUSTRALIA – STEP-BY-STEP GUIDE ON HOW TO APPLY FOR THE COMM BANK NEO CARD

The CommBank Neo Card is a modern, digital-focused credit card ideal for Australians who want a flexible, easy-to-manage card with everyday benefits.

Follow this step-by-step guide to apply directly through the official Commonwealth Bank (CommBank) website.

1 – Access the CommBank Homepage

Visit the official CommBank website: https://www.commbank.com.au/

From the homepage, you can explore all personal banking services, including credit cards, loans, and online banking tools.

Anúncios

2 – Go to the “Credit Cards” Section

On the main navigation bar, click the second option, labeled “Credit Cards.”

This section will display all available CommBank credit card products.

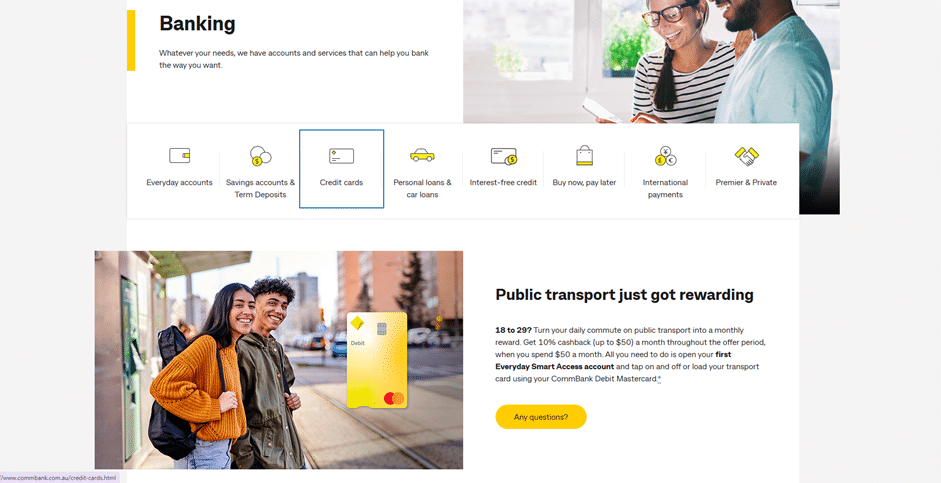

3 – Browse the Available Credit Cards

On this page, you’ll find various CommBank credit cards, including:

- Low Fee Credit Card

- Awards Credit Card, among others

Select the third option — the CommBank Neo Card — to continue.

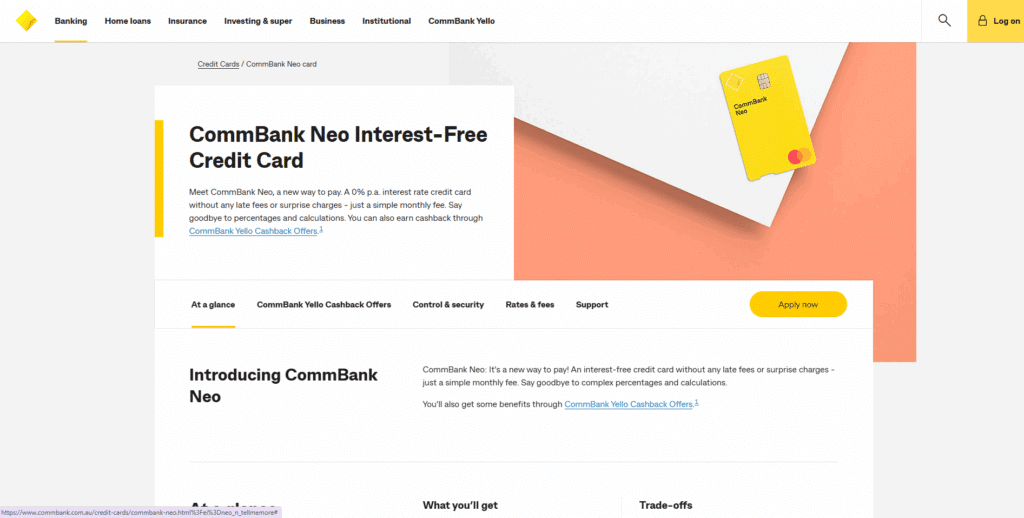

4 – Review the CommBank Neo Card Details

On the Neo Card page, you’ll see complete information about the card, including:

- Features designed for digital banking users

- Cashback and rewards options

- Fees and interest rate details

Click the green “Apply Now” button to start your application.

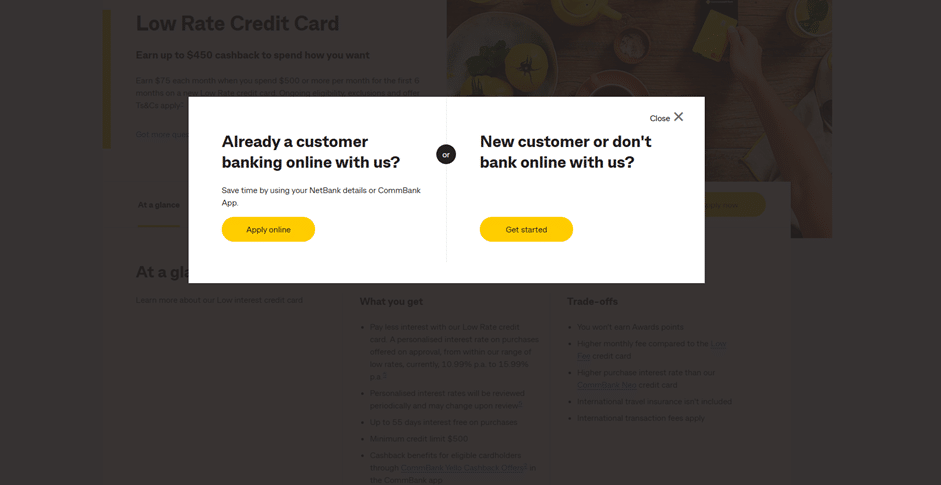

5 – Choose to Log In or Apply as a New Customer

After clicking “Apply Now,” a pop-up window will appear with two options:

- Create a new account if you are a new customer

- Log in if you already bank with CommBank

6 – Complete the Application or Log In

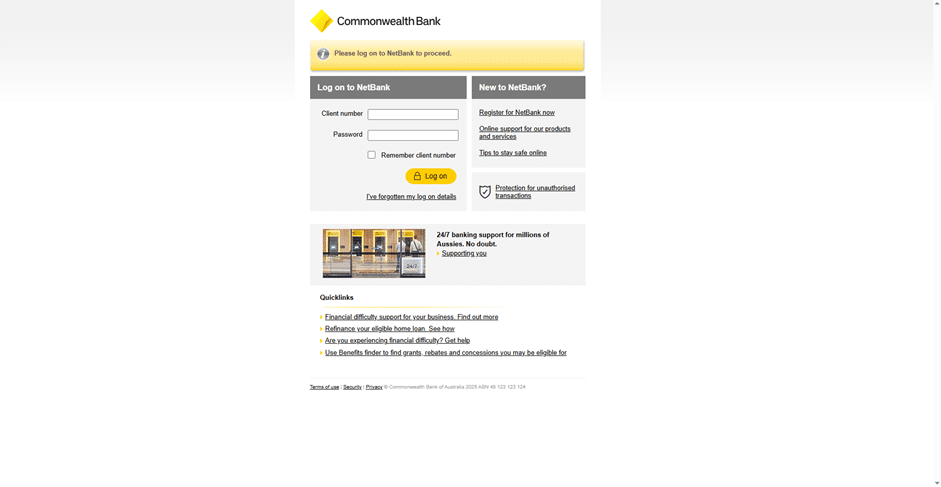

You’ll then be redirected to the CommBank login page.

Follow the instructions based on your situation:

- If you already have a CommBank account, log in to complete your application using your existing information.

- If you don’t have an account, follow the steps to apply as a new customer and submit your details securely online.

After submission, your application will be reviewed, and once approved, your CommBank Neo Card will be sent to you.

Final Notes

The CommBank Neo Card is perfect for Australians who prefer digital-first banking with easy management via the CommBank app.

With cashback rewards, low fees, and full access to NAB’s secure banking platform, it’s a practical and convenient choice for everyday spending.

Step 1: Accessing the Application

To start your application:

- Visit the official CommBank website and navigate to the Credit Cards → Neo section.

- If you are already a CommBank customer, log in using NetBank or the CommBank app to prefill some of your personal information.

- If you are a new customer, click “Get started” to begin a new application.

Step 2: Basic Requirements

Before applying, ensure you meet the following eligibility criteria:

- Minimum age: 18 years old.

- Residency: Australian citizen, permanent resident, or valid visa holder.

- Credit history: Not under bankruptcy or insolvency.

- Financial capacity: Ability to meet card obligations.

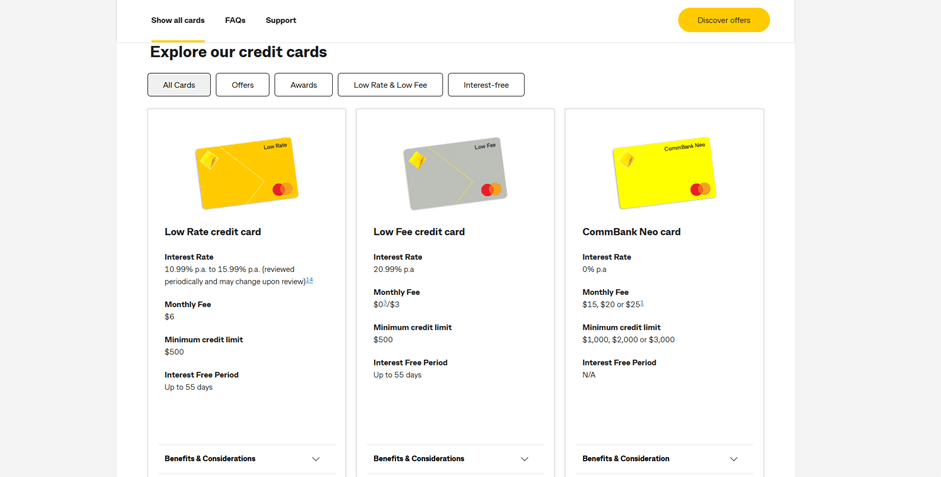

Step 3: Choosing a Credit Limit

The CommBank Neo offers three credit limit options:

- $1,000: $15 monthly fee.

- $2,000: $20 monthly fee.

- $3,000: $25 monthly fee.

You can choose the limit that best fits your financial needs. Note that if you do not use the card and pay the full balance due on time, the monthly fee is waived.

Step 4: Benefits and Features

When applying for the CommBank Neo, you will have access to several benefits:

- Interest-free: 0% p.a. on purchases.

- No late fees: No additional charges for late payments.

- No international transaction fees: Ideal for online purchases abroad.

- No fees for additional cardholders.

- Cashback: Access cashback offers via the CommBank Yello program in the app.

- Control and security: Tools like Lock, Block, Limit to manage and protect your spending.

Step 5: Submission, Approval & Activation

After submitting your application:

- CommBank performs a credit assessment.

- If approved, the card will be mailed to your Australian address.

- Activate the card via NetBank, the CommBank app, or by phone.

- Begin using the card for purchases while enjoying the offered benefits.

Overview of CommBank

The Commonwealth Bank of Australia (CommBank) is one of the largest and most trusted financial institutions in Australia. With a long-standing reputation, CommBank provides a wide range of banking products and services, including everyday banking, loans, investments, and credit cards.

Credibility and Trust

- History: Founded in 1911, CommBank has built decades of reliability and stability.

- Regulation: Supervised by the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC).

- Innovation: A leader in digital banking, offering NetBank and the CommBank app, recognized for security and ease of use.

CommBank

National Presence

CommBank has an extensive network of branches and ATMs across Australia, ensuring accessibility and convenience for all customers.

Frequently Asked Questions (FAQ)

1. What is the CommBank Neo?

The CommBank Neo is an interest-free credit card with no late fees or international transaction fees, offering a simple way to manage payments.

2. What credit limits are available?

$1,000, $2,000, and $3,000, with monthly fees of $15, $20, and $25, respectively.

3. Are there additional fees?

No. There are no late fees, international transaction fees, or fees for adding additional cardholders.

4. How can I earn cashback?

Cashback offers are accessible through the CommBank Yello program in the CommBank app.

5. Can I add an additional cardholder?

Yes, at no extra cost.

6. What happens if I don’t use the card?

If you do not use the card and pay the full balance on time, the monthly fee is waived.

7. How can I manage my spending?

Use the Lock, Block, Limit features in the CommBank app to control and protect your spending.

8. Does the card offer rewards?

No, the CommBank Neo does not offer rewards points programs.

9. Can I use the card for international purchases?

Yes, the card can be used for international purchases without international transaction fees.

10. How do I apply?

Apply online through the official CommBank website using NetBank, the CommBank app, or by starting a new application as a first-time customer.

Conteúdo criado com auxílio de Inteligência Artificial