This comprehensive guide explains how to apply for the NAB Low Rate Card, including the application process, eligibility requirements, benefits, and approval details.

Low Rate

AUSTRALIA – STEP-BY-STEP GUIDE ON HOW TO APPLY FOR THE NAB LOW RATE CASHBACK OFFER CREDIT CARD

Anúncios

If you’re looking for a simple and affordable credit card option in Australia, the NAB Low Rate Cashback Offer Credit Card is designed to help you save on interest and earn cashback on eligible purchases.

Follow this detailed step-by-step guide to apply directly through the official National Australia Bank (NAB) website.

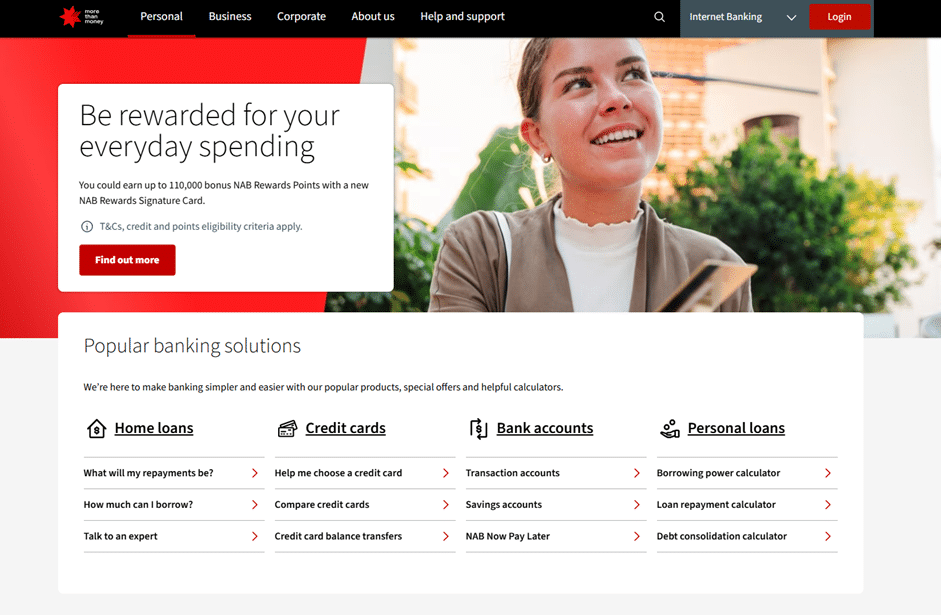

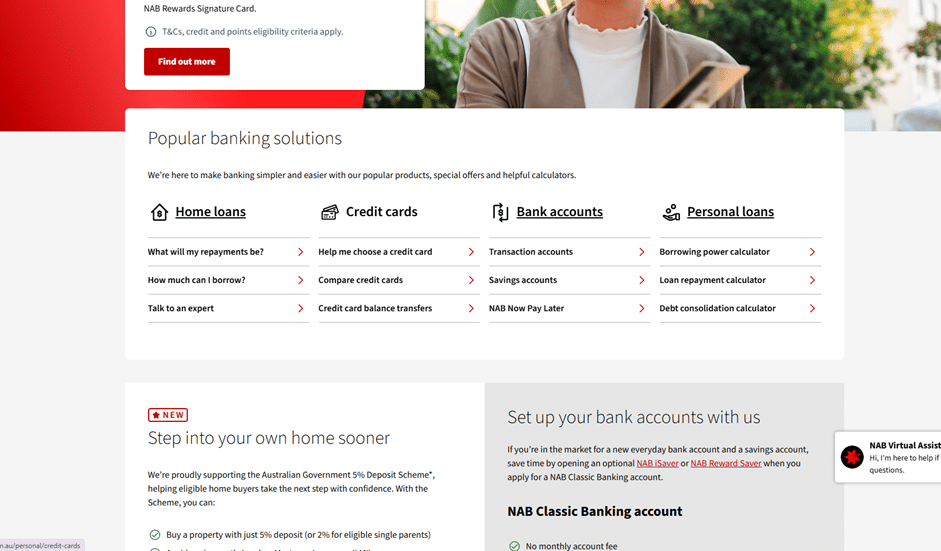

1 – Access the NAB Homepage

Go to the official NAB website: https://www.nab.com.au/

From the homepage, you can access the main navigation menu to explore all credit card options.

Anúncios

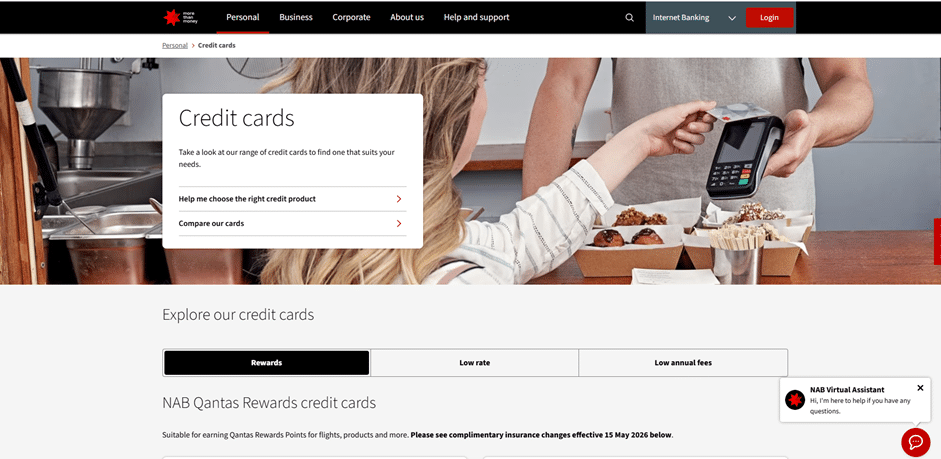

2 – Navigate to the “Credit Cards” Menu

In the top navigation bar, click on the second menu option, labeled “Credit Cards.”

This section will display the range of credit card products currently available at NAB.

3 – Explore NAB Credit Card Options

On the credit cards page, you’ll find several NAB products, including:

- NAB Low Rate Card (balance transfer offer)

- NAB Low Fee Card

- NAB Qantas Rewards Premium Card, among others.

To apply for the NAB Low Rate Cashback Offer, go to the second tab and select the second card option.

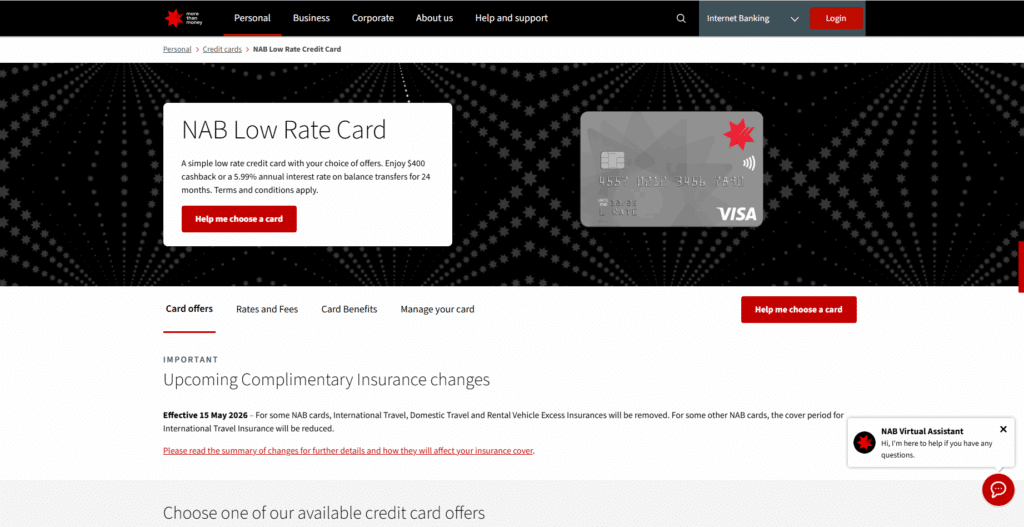

4 – Review the NAB Low Rate Cashback Offer Card Details

On the product page, you’ll find all the key details about the NAB Low Rate Cashback Offer Credit Card, such as:

- Low annual percentage rate (APR)

- Cashback offer on eligible purchases

- Balance transfer options

- Fees and repayment terms

Click the green “Apply Now” button to begin your application process.

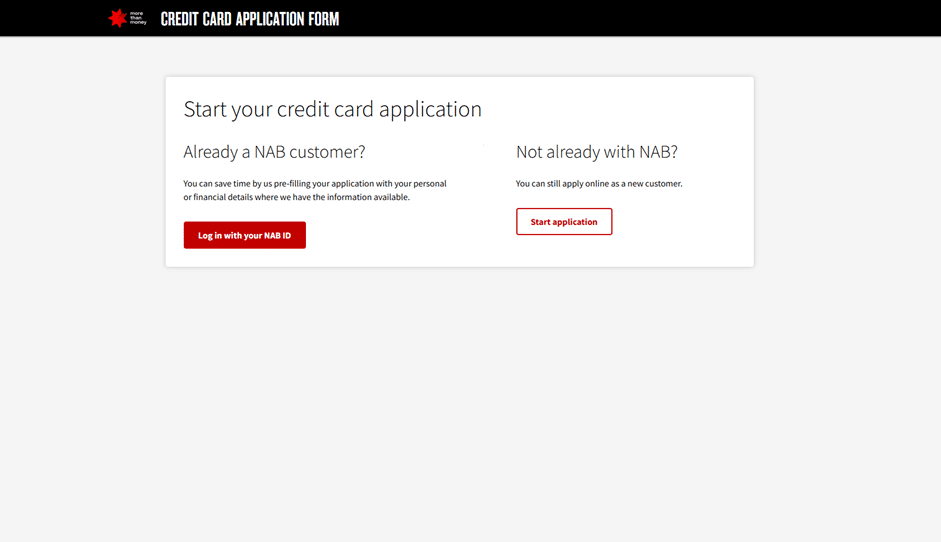

5 – Log In or Start a New Application

After selecting “Apply Now,” you’ll be redirected to the NAB login page.

Here, you’ll see two options:

- If you already have a NAB account, log in to continue your application with your existing customer information.

- If you don’t have an account, choose the option to apply as a new customer and follow the on-screen steps.

Once you’ve completed your application, NAB will process your request and notify you about your approval status.

After approval, your NAB Low Rate Cashback Offer Credit Card will be mailed directly to you.

Final Notes

The NAB Low Rate Cashback Offer is an ideal choice for Australians seeking a practical and cost-effective credit card.

With its competitive low interest rate, cashback rewards, and trusted NAB banking support, this card provides flexibility for everyday expenses while helping you save more on interest payments.

Step 1: Confirm Eligibility & Basic Requirements

Before applying for the NAB Low Rate Card, make sure you meet the main eligibility criteria:

- You must be 18 years or older.

- You must have a valid Australian residential address.

- You need to demonstrate a regular and stable income.

- The minimum credit limit available for this card is AUD 1,000.

- NAB will perform a credit history check to assess your financial reliability.

Meeting these requirements helps ensure a smooth approval process and reduces the chance of rejection.

Step 2: How to Apply

The application process for the NAB Low Rate Card is simple and can be done entirely online or through the NAB app.

- Visit the NAB website and navigate to the “Credit Cards” section.

- Select the “Low Rate” option and choose the NAB Low Rate Card.

- Click “Apply Now” and complete the form with your:

- Full name, date of birth, and contact information

- Employment status and income details

- Residential address and living situation

- Review all terms and conditions carefully before submitting.

- NAB will then conduct a credit check and notify you of the outcome, often within minutes.

Existing NAB customers can log in to online banking to speed up the process, as some personal information may already be pre-filled.

Step 3: Key Rates, Fees & Offers

Understanding the costs associated with your card is essential for making an informed decision.

- Purchase interest rate: 13.49% p.a. (variable)

- Annual fee: AUD 59 (some offers may waive it for the first year)

- Balance transfer rate: Promotional 5.99% p.a. for 24 months (no balance transfer fee)

- Interest-free period: Up to 55 days on purchases when you pay your statement balance in full

- Cash advance rate: Around 21.74% p.a. for ATM or cash withdrawals

These features make the NAB Low Rate Card an excellent choice for Australians who prefer a low-cost credit option over rewards or travel perks.

Step 4: Benefits & Things to Know

Main benefits:

- One of NAB’s lowest purchase interest rates, ideal for managing repayments.

- Balance transfer promotions to help consolidate higher-interest debt.

- Additional cardholder option at no extra cost.

- Visa network security, including global fraud monitoring and emergency assistance.

Important considerations:

- The card does not earn rewards points.

- There are no complimentary insurances such as travel or purchase protection.

- Failing to pay your full monthly balance removes interest-free days and triggers standard purchase rates.

This card is best suited for people who value simplicity and low interest rates rather than premium perks or frequent flyer programs.

Step 5: Approval, Activation & Usage

Once you submit your application, NAB will evaluate your income, credit history, and existing debts. If approved:

- Your physical card will arrive by mail.

- Activate it via the NAB app or NAB Internet Banking.

- Begin using your card for everyday purchases and take advantage of interest-free days by paying your balance in full each month.

Responsible use of the card helps improve your credit profile and ensures ongoing access to NAB’s competitive financial products.

Overview of NAB: Credibility, Strength, and Market Position

NAB (National Australia Bank) is one of Australia’s most trusted and established financial institutions. Understanding its key strengths helps explain why its Low Rate Card is such a reliable choice.

- Strong Presence Among Australia’s Big Four Banks

NAB is one of the largest and most respected banks in Australia, serving millions of customers across retail, business, and institutional sectors. - Focus on Competitive, Low-Interest Products

NAB is known for offering accessible, low-rate financial products that prioritize affordability and transparency.

- Robust Security and Customer Protection

NAB provides advanced fraud detection, card monitoring, and 24/7 customer support, ensuring cardholders’ financial safety both locally and internationally. - Commitment to Transparency and Responsibility

The bank maintains clear communication on all fees, rates, and conditions, empowering customers to make informed financial decisions.

NAB Bank

These values have made NAB a trusted name in Australian banking, known for balancing accessibility with reliability.

FAQ – Common Questions About the NAB Low Rate Card

1. Does the NAB Low Rate Card offer rewards points?

No. The card focuses on low interest rates and straightforward credit management instead of a rewards system.

2. What credit score do I need for approval?

A good to very good credit score is recommended, though NAB considers income, debt, and repayment history as part of its overall assessment.

3. What is the annual fee, and is there a waiver?

The standard annual fee is AUD 59, but introductory offers sometimes waive this for the first year.

4. How long does approval take?

Most applicants receive a decision within minutes. In some cases, NAB may require additional verification, which can take a few days.

5. How does the balance transfer offer work?

Eligible applicants can transfer existing card balances at 5.99% p.a. for 24 months. After this period, any unpaid balance reverts to the standard cash advance rate.

6. Are there interest-free days on purchases?

Yes. You can enjoy up to 55 interest-free days if you pay your full statement balance on time each month.

7. Can I add another cardholder?

Yes, you can add one additional cardholder at no extra cost.

8. What happens if I don’t pay off my full balance?

You will lose your interest-free days and pay the standard purchase rate (13.49% p.a.) on the remaining balance.

9. Does the card include travel or purchase insurance?

No. The NAB Low Rate Card does not include complimentary insurance benefits.

10. Who is this card best for?

This card is ideal for people seeking a simple, low-interest credit card without complex rewards systems or high annual fees.

Conteúdo criado com auxílio de Inteligência Artificial