This section gives a thorough, step-by-step guide to applying for the CommBank Low Fee Credit Card: how to access the application, what requirements you must meet, and what to expect in the approval process.

Low fee

AUSTRALIA – STEP-BY-STEP GUIDE ON HOW TO APPLY FOR THE COMM BANK LOW FEE CREDIT CARD

The CommBank Low Fee Credit Card is ideal for Australians looking for a cost-effective credit card with lower annual fees while still offering rewards and essential benefits.

Follow this clear, step-by-step guide to apply directly through the official Commonwealth Bank (CommBank) website.

Anúncios

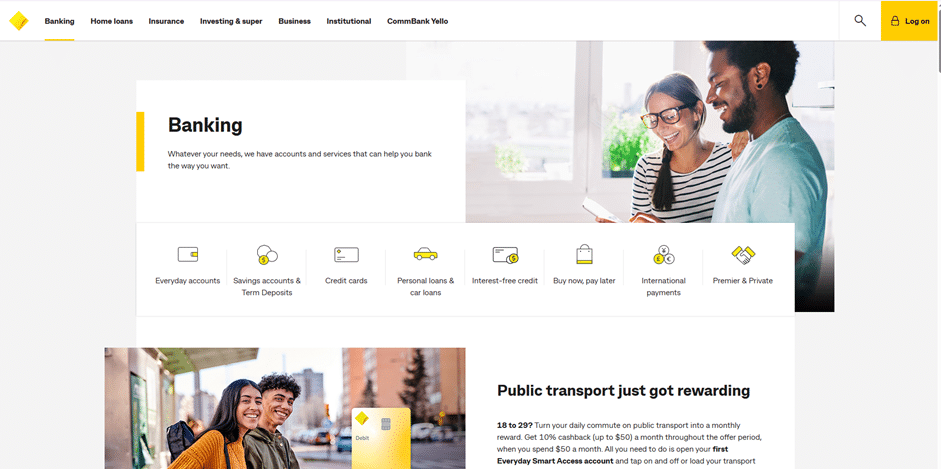

1 – Access the CommBank Homepage

Visit the official CommBank website: https://www.commbank.com.au/

From the homepage, you can navigate to explore personal banking services, including credit cards, loans, and online banking tools.

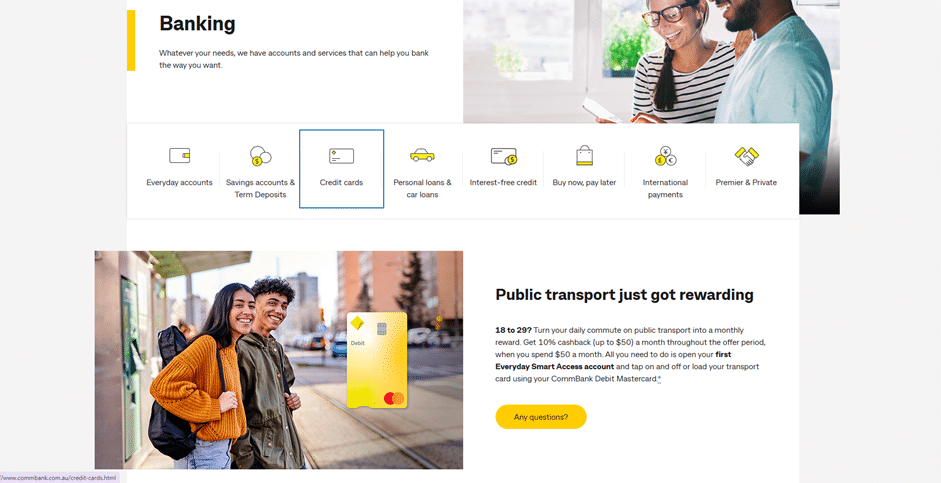

2 – Go to the “Credit Cards” Section

On the main navigation bar, click the second option, labeled “Credit Cards.”

This section displays all CommBank credit card products and provides detailed information for each.

Anúncios

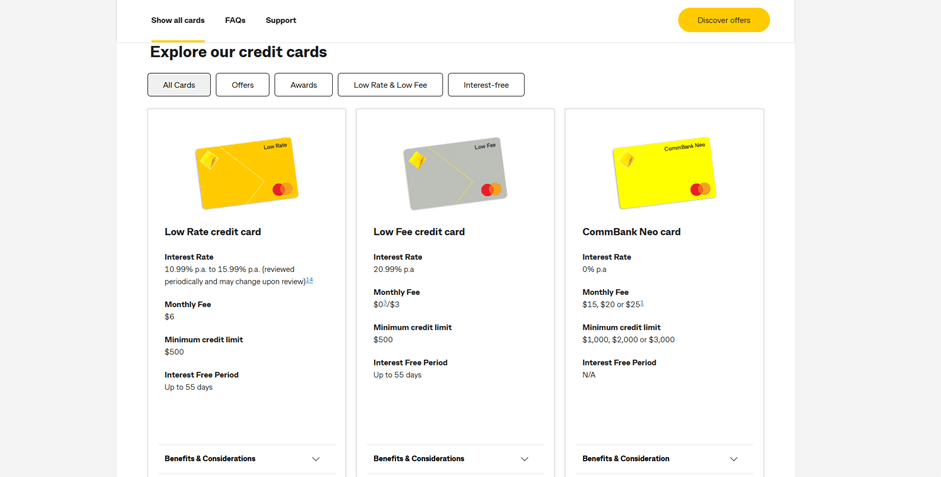

3 – Browse the Available Credit Cards

On this page, you’ll find several CommBank credit cards, including:

- Low Rate Credit Card

- CommBank Neo Card

- Awards Credit Card, among others

Select the second option — the Low Fee Credit Card — to proceed.

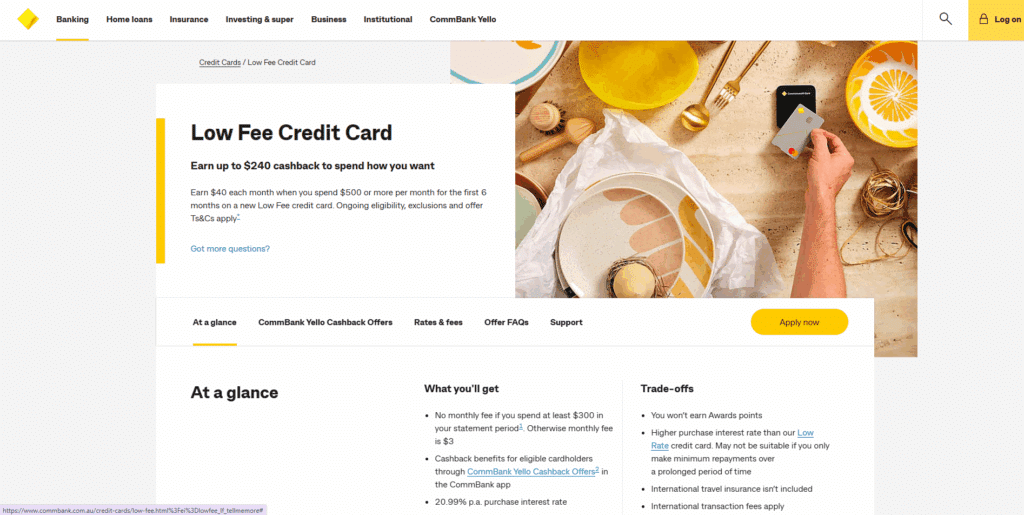

4 – Review the Low Fee Credit Card Details

On the Low Fee Credit Card page, you’ll see all the key information about the card, including:

- Annual fee details and interest rates

- Rewards or points programs

- Balance transfer options and benefits

When ready, click the green “Apply Now” button to start your application.

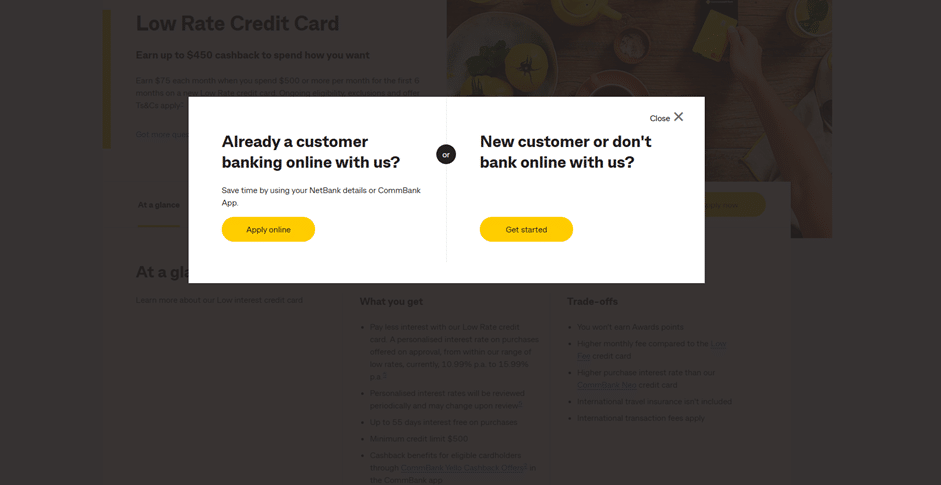

5 – Choose to Log In or Apply as a New Customer

After clicking “Apply Now,” a pop-up window will appear giving you two options:

- Create a new account if you are a new customer

- Log in if you already bank with CommBank

6 – Complete the Application or Log In

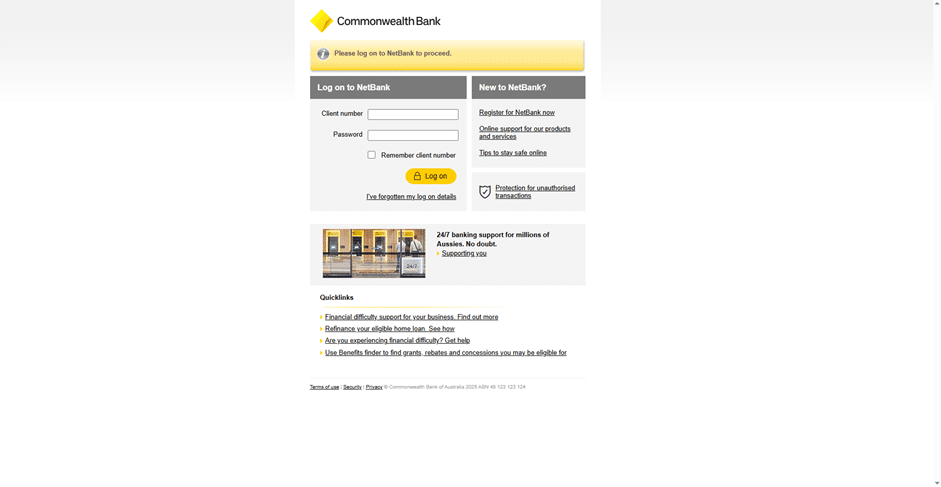

You’ll then be redirected to the CommBank login page.

Follow the instructions based on your situation:

- If you already have a CommBank account, log in to complete your application with your existing information.

- If you don’t have an account, follow the steps to apply as a new customer and submit your details securely online.

After submission, your application will be reviewed, and once approved, your CommBank Low Fee Credit Card will be mailed to you.

Final Notes

The CommBank Low Fee Credit Card is a practical option for Australians who want to reduce annual fees while still enjoying the benefits of a rewards credit card.

With simple online application, reliable banking support, and flexible features, it is ideal for everyday spending and managing your finances efficiently.

Step 1: Access the Application & Prepare to Apply

- Start by going to the official CommBank website, and navigate to the “Credit Cards → Low Fee” section.

- On the Low Fee page, click “Apply now” (or equivalent) to launch the online application.

- If you already bank with CommBank, log in via NetBank or the CommBank mobile app first; part of your personal information may pre-fill.

- Gather essential documents before applying: proof of identity (e.g. passport, driver’s license), proof of income (e.g. payslips or tax returns), proof of address, and visa or residency documents if applicable.

Step 2: Eligibility & Basic Requirements

Before applying, ensure you satisfy CommBank’s eligibility criteria for credit cards:

- You must be at least 18 years old.

- You must be an Australian or New Zealand citizen, or an Australian permanent resident, or hold an eligible visa (with sufficient validity).

- You must live in Australia and provide a valid Australian residential address.

- You should not currently be under bankruptcy or insolvency arrangements.

- You must satisfy CommBank’s credit assessment, showing capacity to service the credit (your income, existing debts, credit history).

- CommBank may request additional proofs, such as recent payslips or bank statements, to verify your claims.

Step 3: Understand the Rates, Fees & Key Features

A strong understanding of the costs and limits is vital before applying.

- Monthly fee: AUD 3; however, the monthly fee is waived if you spend at least AUD 300 in that statement period.

- Interest-free period: Up to 55 days on purchases, provided you pay your full statement balance by the due date.

- Purchase interest rate: The standard rate is 20.99% p.a. variable for purchases.

- Cash advance rate: Around 21.99% p.a. for cash withdrawals or cash-equivalent transactions.

- Other fees: Late payment fee (approx. AUD 20), international transaction fee (3.5% on foreign currency spending), and overlimit fees when applicable.

- Additional cardholder: You can add an additional cardholder at no extra cost.

- Minimum credit limit: The card’s minimum credit limit is AUD 500.

Because this is a “Low Fee” card, it emphasizes minimal ongoing cost (if you meet the spend threshold) rather than generous rewards or premium perks.

Step 4: Offers, Benefits & Extra Features

Though the Low Fee card is basic, there are extra features and potential promotional offers to consider:

- Cashback offers: CommBank may offer cashback incentives (for example, up to AUD 240 total) when new cardholders spend a certain monthly amount in early months.

- No monthly fee when threshold met: If you spend AUD 300 or more in the statement period, the AUD 3 fee is waived for that month.

- Insurance & protections: Eligible purchases may receive purchase security insurance and extended warranty.

- Control features: The card includes safety and spending tools like Lock, Block, Limit, letting you block certain transactions or set caps.

- SurePay instalments: You may be able to convert purchases or balances into fixed instalment payments over a term.

Step 5: Submit, Approval & Activate

- After submitting your online application, CommBank will run credit checks and evaluate your finances.

- If approved, you’ll receive a decision (often quickly) and your new card will be mailed to your Australian address.

- Once you receive the physical card, activate it via NetBank, the CommBank app, or by phone.

- After activation, you can use the card for purchases. To get full benefit, aim to meet the AUD 300 spend threshold each statement so the fee is waived and to pay off your full balance monthly to avoid interest.

Overview of CommBank — Credibility, Role & Strengths in Australia

Below is a concise overview of the Commonwealth Bank of Australia (CommBank): its reputation, institutional strength, and position in the Australian financial market.

CommBank

About CommBank

CommBank is one of Australia’s largest and most established banks. It offers a full spectrum of financial services: retail banking, business banking, credit cards, loans, investments, insurance, digital banking, and wealth management. It is regulated under Australian financial law and operates under a banking license.

Reputation & Customer Trust

- CommBank is known for its stability and brand reliability, being a household name in Australia.

- It provides clear disclosure of fees, rates, and conditions for its credit card products via “Key Facts” documents, helping consumers make informed comparisons.

- It adheres to consumer credit regulations, responsible lending standards, and publishes a Target Market Determination to ensure its card products are distributed appropriately.

- CommBank invests in strong digital infrastructure (NetBank, mobile app) allowing users to manage cards, view statements, set transaction limits, and monitor security.

Market Position & Strategy

- As one of Australia’s “Big Four” banks, CommBank commands significant presence across branches, ATMs, and digital services nationwide.

- It offers a range of credit card products — Low Fee, Low Rate, Awards, Neo, etc. — to serve different customer profiles.

- The Low Fee Credit Card is intended for consumers who want to minimize ongoing costs and manage spending simply, rather than chasing rewards.

- Because of its scale and reputation, CommBank can support integrated banking experience (credit, savings, loans) and risk management at scale.

FAQ — Common Questions About the CommBank Low Fee Credit Card

1. Will I always pay the AUD 3 monthly fee?

No. The monthly fee is waived if you spend at least AUD 300 during the statement period.

2. What is the purchase interest rate?

The standard purchase rate is 20.99% per annum (variable).

3. How many interest-free days do I get on purchases?

You can get up to 55 interest-free days, provided you pay your statement balance in full by the due date.

4. What is the interest rate on cash advances?

Cash advances are charged at around 21.99% p.a., and typically incur additional cash advance fees.

5. Are there additional cardholder fees?

No. You can add an additional cardholder at no extra cost.

6. What is the minimum credit limit?

The minimum credit limit for this card is AUD 500.

7. Does the card offer cashback or rewards points?

It does not offer standard rewards points. However, eligible cardholders may access cashback offers via the CommBank Yello program.

8. Are there any insurance or protection benefits?

Yes, the card offers purchase security insurance and extended warranty on eligible items (subject to conditions).

9. What fees apply beyond the monthly and interest fees?

Other fees may include late payment fees (AUD 20), overlimit fees, international transaction fees (3.5%), and cash advance fees.

10. How long does approval take?

Decisions are often given quickly (within minutes). In some cases, additional documents or verification may be required, which can extend the process.

Conteúdo criado com auxílio de Inteligência Artificial