This is a complete and practical guide showing how to apply for the CommBank Low Rate Credit Card in Australia. Below, you’ll learn how to access the application, what eligibility criteria to meet, and how the approval process works.

Low Card

AUSTRALIA – STEP-BY-STEP GUIDE ON HOW TO APPLY FOR THE COMM BANK Low Rate CREDIT CARD

The CommBank Low rate Credit Card is one of Australia’s most popular rewards cards, offering points on everyday purchases that can be redeemed for travel, shopping, gift cards, and more.

Follow this simple step-by-step guide to apply directly through the Commonwealth Bank (CommBank) website.

Anúncios

1 – Access the CommBank Homepage

Visit the official Commonwealth Bank website: https://www.commbank.com.au/

From the homepage, you can explore various personal banking options, including credit cards, loans, and digital banking tools.

2 – Go to the “Credit Cards” Section

On the main navigation bar, click the second option, labeled “Credit Cards.”

This will take you to the page where all CommBank credit card products are listed.

Anúncios

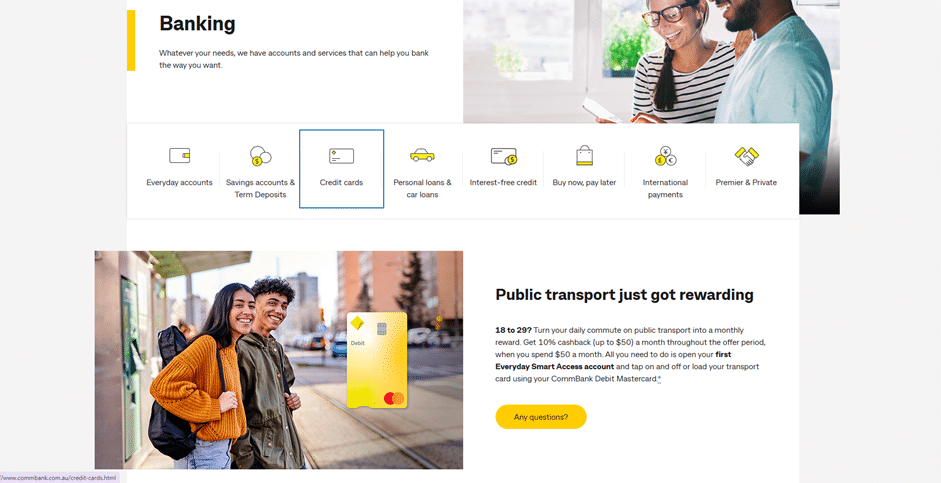

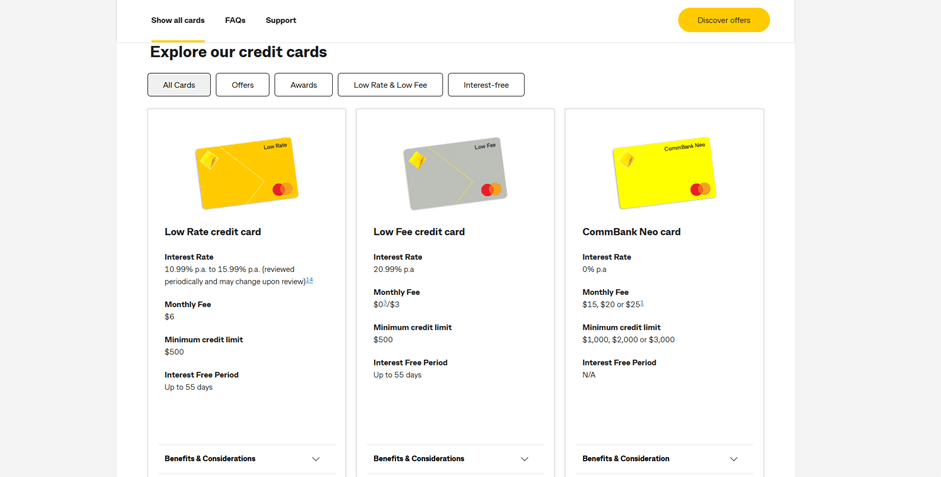

3 – Browse the Available Credit Cards

On this page, you’ll find detailed information about several CommBank credit cards, including:

- Low Fee Credit Card

- Low Rate Credit Card

- CommBank Neo Card, among others.

Select the first option — the Low rate credit card — to proceed.

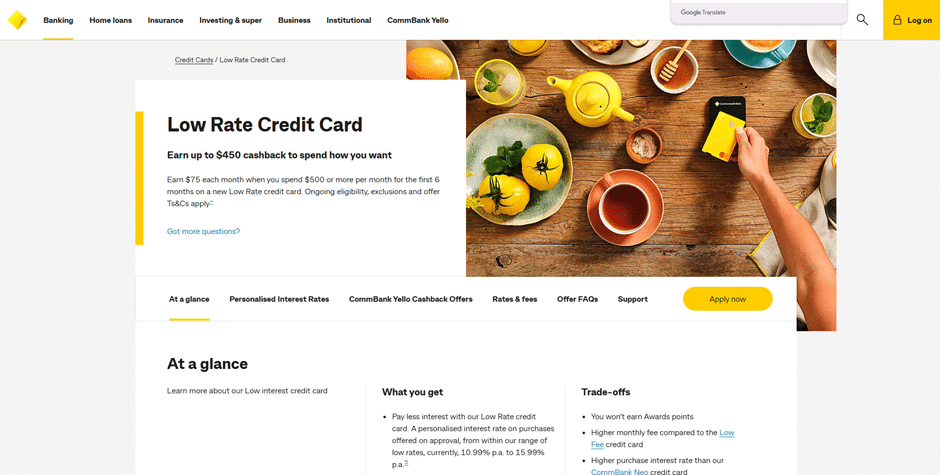

4 – Review the CommBank Low rate Credit Card Details

On the rate Credit Card page, you’ll find all the key information about the card, such as:

- How to earn CommBank rate points on everyday spending

- Available bonus point offers

- Annual fees and interest rate information

- Included insurance and travel benefits

Once you’ve reviewed the details, click the green “Apply Now” button to start your application.

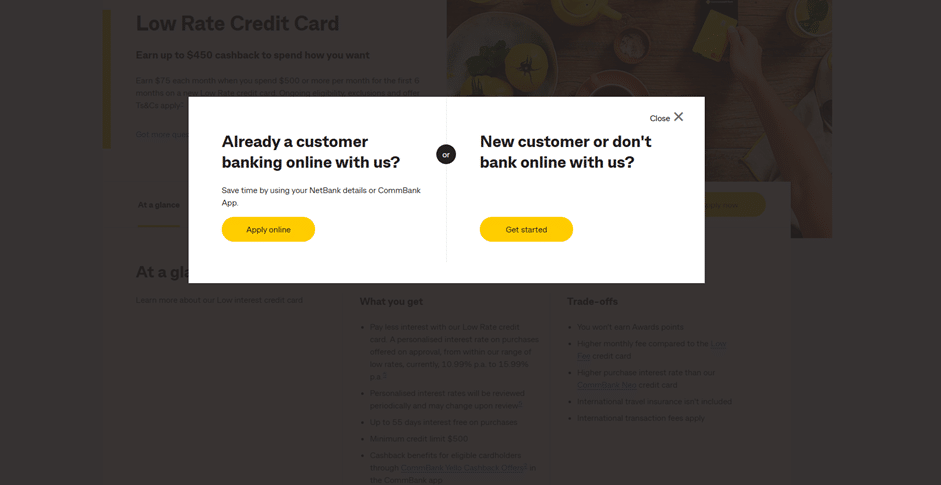

5 – Choose to Log In or Apply as a New Customer

After clicking “Apply Now,” a pop-up window will appear with two options:

- Create an account if you are a new customer

- Log in if you already bank with CommBank

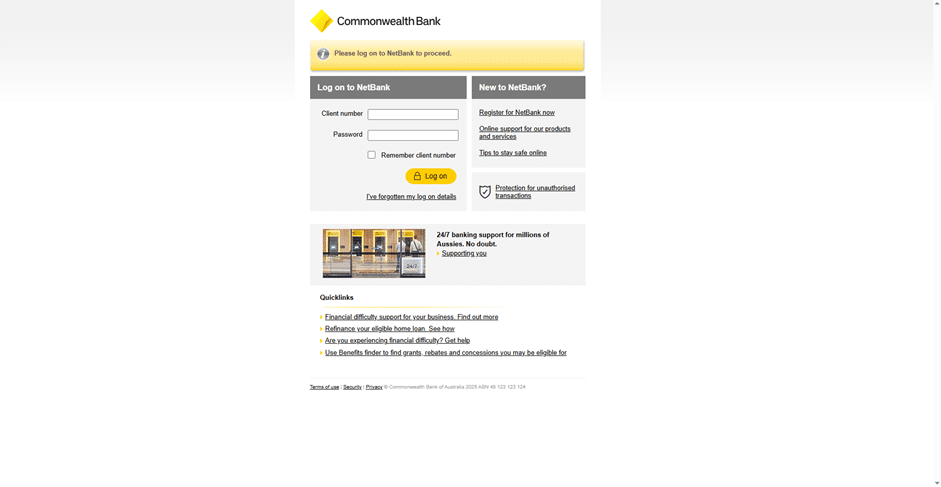

6 – Complete the Application or Log In

You’ll then be redirected to the CommBank login page.

Here, follow the instructions based on your situation:

- If you already have a CommBank account, log in to complete your application quickly using your saved details.

- If you don’t have an account, follow the steps to apply as a new customer and submit your details securely online.

Once you’ve finished the process, your application will be reviewed, and upon approval, your CommBank low rate Credit Card will be sent to you.

Final Notes

The CommBank Low Rate Credit Card is a versatile option for Australians who want to earn reward points on everyday purchases and enjoy exclusive perks.

With flexible redemption options, travel insurance, and access to one of the largest rewards programs in Australia, it’s a great way to make your spending more rewarding.

Step 1: Accessing the Application & Preparing to Apply

- Begin by visiting the official CommBank website and navigating to the Low Rate Credit Card section.

- Click “Apply now” and start your online application.

- If you are already a CommBank customer with NetBank or the CommBank app, you can log in first to prefill some of your details.

- Before starting, make sure you have the required documentation — personal identification, proof of income, proof of address, and visa or residency evidence if applicable.

Step 2: Eligibility & Requirements

Before applying, you need to meet the following eligibility criteria:

- Be at least 18 years old.

- Be an Australian or New Zealand citizen, an Australian permanent resident, or hold an eligible visa valid for at least six months.

- Live in Australia and have a valid Australian residential address.

- Not be under bankruptcy or insolvency arrangements.

- Have sufficient income and a good credit history to meet CommBank’s credit assessment standards.

- Be ready to provide documents such as payslips, bank statements, and identity verification if requested.

Step 3: Understanding Rates, Fees & Card Features

Before applying, it’s important to understand the key costs and benefits of the Low Rate card:

- Monthly fee: AUD 6 (equivalent to AUD 72 annually).

- Interest-free period: Up to 55 days on purchases when you pay your balance in full each month.

- Purchase interest rate: A variable low rate, typically between 10.99% and 15.99% per annum, depending on your personal credit profile.

- Cash advance rate: Around 21.99% per annum, applied to ATM withdrawals or cash-like transactions.

- Additional cardholder fee: No additional fee for adding an extra cardholder.

- Overlimit fee: A fee (usually AUD 15) may apply if you exceed your credit limit.

- Other fees: Cash advance fees, late payment fees, and foreign transaction fees may apply.

The CommBank Low Rate Credit Card is designed for people who prefer a simple, low-cost credit option rather than rewards or premium perks.

Step 4: Bonus Offers and Extra Benefits

The card may include promotional offers and convenient features, such as:

- Cashback promotions: CommBank sometimes offers up to AUD 75 cashback per month when you meet a minimum monthly spend (for example, $500) for the first six months — totalling up to $450.

- Personalised interest rates: Your final rate is determined based on your credit profile, giving responsible borrowers access to lower rates.

- Complimentary insurance: Eligible purchases are covered by Purchase Security Insurance and Extended Warranty.

- SurePay instalment plans: The option to convert purchases or balances into fixed monthly repayments for better budgeting control.

Step 5: Submission, Approval & Activation

- After submitting your online application, CommBank performs a credit check and assesses your financial capacity.

- If approved, you’ll receive a notification, and your card will be mailed to your registered address.

- Once you receive it, activate the card using NetBank, the CommBank app, or by phone.

- After activation, you can start using the card for purchases, online payments, or contactless transactions.

- To make the most of the 55-day interest-free period, always aim to pay your full statement balance by the due date.

Overview of CommBank — Credibility, Role & Reputation in Australia

Here’s a clear overview of Commonwealth Bank of Australia (CommBank) — one of the country’s most established and trusted financial institutions.

CommBank

About CommBank

CommBank is one of Australia’s “big four” banks and a leader in retail and commercial banking. It provides a full range of services including everyday banking, business loans, home loans, investment services, and credit cards.

Founded in 1911, it is a publicly listed company and regulated by the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC).

Reputation & Consumer Trust

- CommBank has earned a strong reputation for financial stability, digital innovation, and customer transparency.

- It provides clear “Key Facts” and fee disclosures for all its credit card products, helping customers compare options easily.

- The bank operates under strict compliance with Australian consumer credit laws, ensuring fair lending practices.

- CommBank’s NetBank and mobile app are among the most advanced digital banking platforms in the country, allowing cardholders to manage payments, view statements, and control spending securely.

Market Presence & Digital Services

- CommBank serves millions of customers across Australia through an extensive branch and ATM network.

- It also invests heavily in cybersecurity and digital infrastructure, ensuring safe and convenient banking experiences.

- The bank offers several types of credit cards — Low Rate, Low Fee, Awards, and Neo — designed for different customer needs.

- The Low Rate Credit Card stands out as the ideal choice for customers who want lower interest charges and flexible repayment options without paying for unnecessary extras.

FAQ — Common Questions About the CommBank Low Rate Credit Card

1. What is the monthly fee for the card?

The CommBank Low Rate Credit Card has a monthly fee of AUD 6, which equals AUD 72 per year.

2. What is the interest rate on purchases?

The purchase rate is variable, typically ranging between 10.99% and 15.99% per annum, depending on your credit assessment.

3. Do I get any interest-free period?

Yes, you can enjoy up to 55 interest-free days on purchases if you pay your full statement balance by the due date.

4. How much is the interest on cash advances?

Cash advances generally incur a rate of around 21.99% per annum, plus applicable fees.

5. Are there any introductory offers?

Yes, new applicants may receive cashback offers such as $75 per month for six months when spending a minimum amount each month.

6. What kind of insurance coverage comes with the card?

The Low Rate Credit Card includes complimentary Purchase Security Insurance and Extended Warranty on eligible items.

7. Can I add another cardholder?

Yes, you can add an additional cardholder at no extra cost.

8. What documents do I need to apply?

You’ll need valid identification (passport or driver’s licence), proof of income (recent payslips or statements), and proof of address.

9. What happens if I go over my credit limit?

If you exceed your credit limit, a small overlimit fee (around AUD 15) may be charged.

10. How long does approval take?

Most applications receive an initial decision within minutes. Some may take longer if additional verification is needed.

Final Thoughts

The CommBank Low Rate Credit Card offers one of the most affordable credit solutions for Australian consumers seeking flexibility, reliability, and low interest costs. Backed by the trusted Commonwealth Bank brand, it’s a practical option for everyday spending with manageable fees and straightforward benefits.

Conteúdo criado com auxílio de Inteligência Artificial