This guide explains how to apply for the NAB Rewards Signature Card, including eligibility, the application process, card benefits, and approval details.

NAB Rewards Signature

AUSTRALIA – STEP-BY-STEP GUIDE ON HOW TO APPLY FOR THE NAB REWARDS SIGNATURE CREDIT CARD

If you’re looking for a premium rewards card that offers flexibility and exclusive benefits, the NAB Rewards Signature Credit Card is an excellent choice for Australian consumers.

Follow this detailed, step-by-step tutorial to learn exactly how to apply for your card directly on the official National Australia Bank (NAB) website.

Anúncios

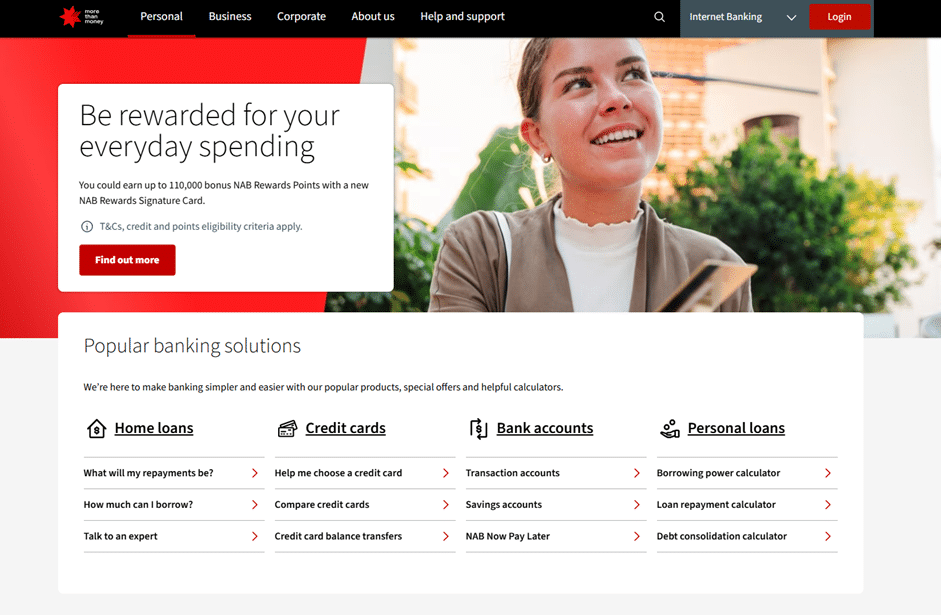

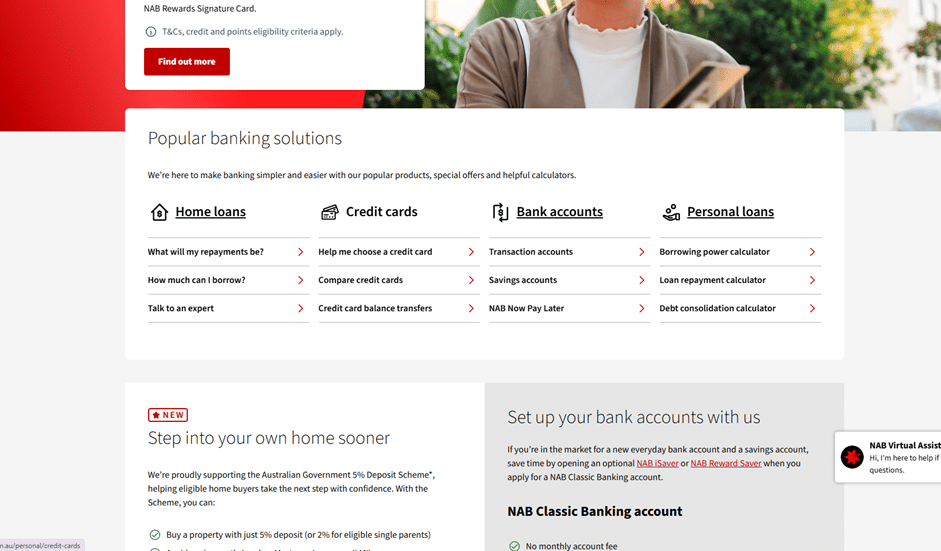

1 – Access the NAB Homepage

Visit the official NAB website: https://www.nab.com.au/

From the homepage, navigate through the main menu to access NAB’s full range of credit card options.

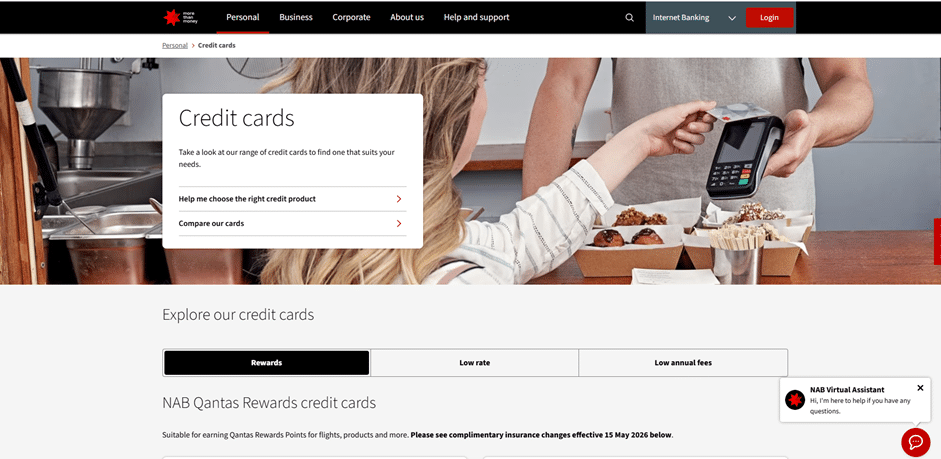

2 – Go to the “Credit Cards” Section

On the top navigation bar, click on the second menu option, labeled “Credit Cards.”

This will take you to the page displaying all available NAB credit card products.

Anúncios

3 – Explore the Available Credit Cards

On this page, you’ll find detailed information about various NAB credit cards, including:

- NAB Low Rate Card (balance transfer offer)

- NAB Low Fee Card

- NAB Qantas Rewards Premium Card, among others.

Select the fourth option — the NAB Rewards Signature Card — to continue.

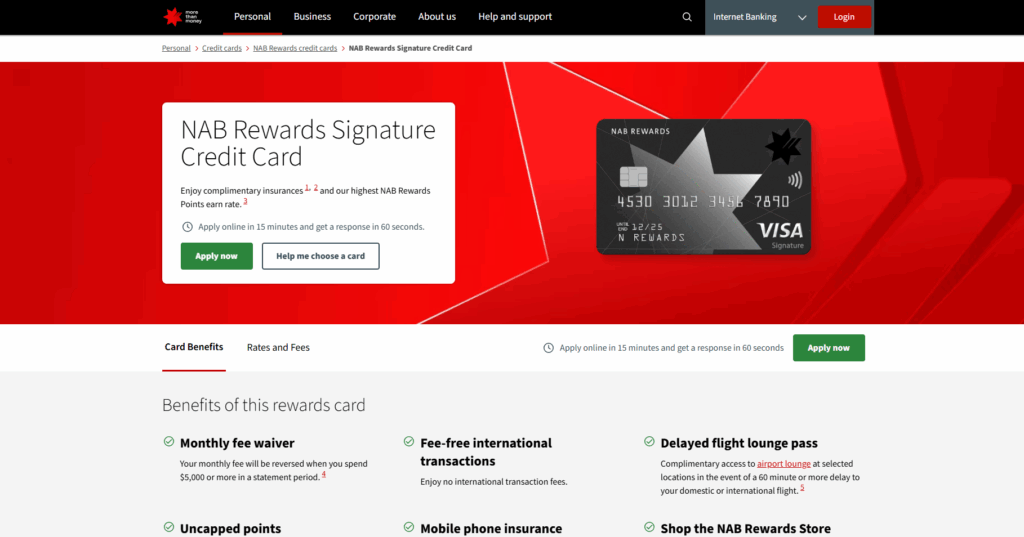

4 – Review the NAB Rewards Signature Card Information

Once you open the NAB Rewards Signature page, you’ll find comprehensive details about the card, such as:

- NAB Rewards Points earning rates on everyday purchases

- Bonus point offers for new applicants

- Travel and lifestyle benefits, including insurance coverage

- Annual fees, limits, and interest rate information

When ready to apply, click the green “Apply Now” button to proceed.

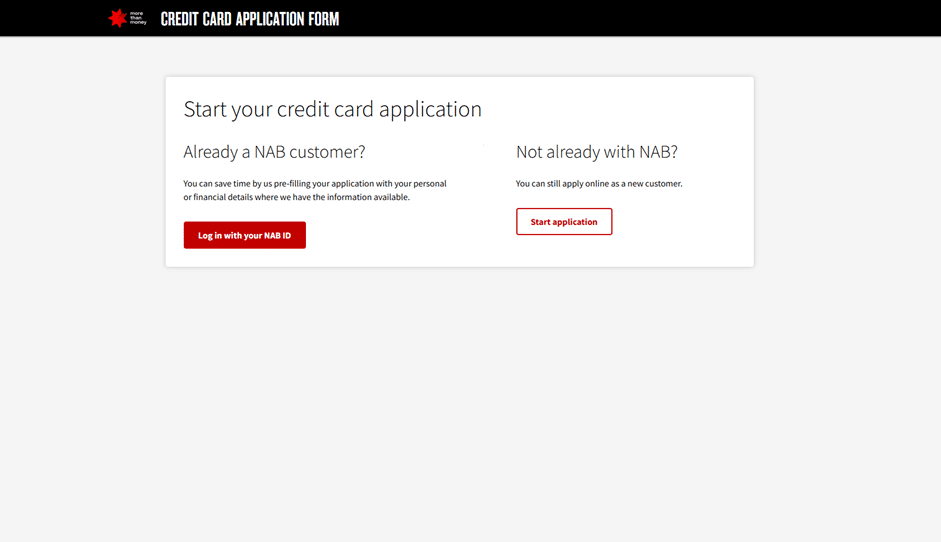

5 – Log In or Start a New Application

After clicking “Apply Now,” you’ll be redirected to the NAB login page.

Here, you’ll receive different instructions depending on your situation:

- If you already have a NAB account, log in to apply quickly using your existing customer details.

- If you don’t have an account, follow the instructions to apply as a new customer and fill out the required online form.

Once you’ve completed the process, your application will be reviewed. If approved, you’ll soon receive your NAB Rewards Signature Credit Card by mail.

Final Notes

The NAB Rewards Signature Card is a top-tier choice for Australians who value premium benefits and flexible rewards.

With bonus point offers, travel privileges, and access to the NAB Rewards program, it combines prestige and practicality — all backed by the security and reliability of one of Australia’s Big Four banks, NAB.

Step 1: Confirm Eligibility & Basic Requirements

Before applying, make sure you meet the following criteria required by NAB:

- You must be 18 years or older.

- You need to have a regular and verifiable income.

- You must be an Australian resident for tax purposes, or an Australian or New Zealand citizen, or hold a temporary visa accepted by NAB.

- The minimum credit limit for this card is AUD 15,000.

Meeting these conditions improves your chances of fast approval.

Step 2: How to Apply

The NAB Rewards Signature Card application process is straightforward and can be completed online or via the NAB app.

- Go to the NAB website and access the Credit Cards section.

- Select the Rewards Card options and choose the NAB Rewards Signature Card.

- Click “Apply Now” and fill out your personal, employment, and income details.

- Read and accept the terms and conditions before submitting your application.

- NAB will conduct a credit assessment and provide a decision — often within minutes for most applicants.

Existing NAB customers can apply through NAB Internet Banking or the NAB app, which helps speed up the process since some information is pre-filled.

Step 3: Costs, Interest Rates & Main Features

Understanding the cost structure of the NAB Rewards Signature Card is essential for informed financial decisions.

| Feature | Details |

|---|---|

| Monthly Fee | AUD 35 per month (waived if you spend AUD 5,000 or more in a statement period) |

| Purchase Interest Rate | 20.99% p.a. variable |

| Cash Advance Rate | 21.74% p.a. variable |

| Balance Transfer Offer | 0% p.a. for 12 months with a one-off fee (around 3%) |

| Interest-Free Days | Up to 44 days on purchases if you pay your balance in full each month |

These conditions make the card ideal for frequent spenders who can meet the spending threshold to have the monthly fee waived.

Step 4: Key Benefits & Rewards

The NAB Rewards Signature Card offers a premium range of perks and rewards, including:

- Bonus NAB Rewards Points – Earn bonus points when you meet a specified spending target within the first few months.

- Uncapped Monthly Points – Earn NAB Rewards Points every month with no limit.

- No International Transaction Fees – Save money on overseas or foreign currency purchases.

- Complimentary Insurances – Includes international travel insurance, domestic flight coverage, rental car excess cover in Australia, and mobile phone insurance.

- Flight Delay Lounge Access – Access participating lounges when your flight is delayed for more than 60 minutes.

- Additional Cardholder Option – Add one additional cardholder at no extra cost.

These benefits position the NAB Rewards Signature Card as a top-tier product for Australians who travel often and want to earn points quickly.

Step 5: Approval, Activation & Smart Usage

Once approved, NAB will send your card by mail. To activate:

- Log in to NAB Internet Banking or open the NAB app.

- Select the new card and follow the activation steps.

- Set a PIN and start using your card.

Tips for smart card management:

- Spend AUD 5,000 or more in statement periods to waive the monthly fee.

- Pay your balance in full each month to enjoy interest-free days.

- Redeem your NAB Rewards Points for travel, shopping, or partner loyalty programs.

Overview of NAB: Credibility and Market Strength

NAB (National Australia Bank) is one of the most reputable financial institutions in Australia. Below are four defining characteristics that reflect its credibility and leadership in the market:

- Member of the “Big Four” Australian Banks

NAB is one of the largest and most trusted banks in Australia, serving millions of customers and maintaining strong financial stability.

NAB Bank

- Focus on Competitive and Reward-Driven Products

NAB provides a wide range of cards, from low-rate options to premium rewards cards, catering to different customer profiles and spending habits.

- Transparent Fees and Responsible Lending

NAB maintains clear communication on rates, fees, and rewards conditions, ensuring customers make informed credit decisions. - Enhanced Security and Global Access

All NAB credit cards include Visa global fraud monitoring, contactless technology, and 24/7 customer support for secure use worldwide.

FAQ – Common Questions About the NAB Rewards Signature Card

1. What is the minimum credit limit for this card?

The minimum credit limit is AUD 15,000.

2. How can I avoid the monthly fee?

The AUD 35 monthly fee is waived if you spend AUD 5,000 or more in a statement period.

3. Are there international transaction fees?

No. This card charges no international transaction fees for purchases made overseas or in foreign currencies.

4. Does the card offer bonus points for new customers?

Yes. New customers can earn a large number of bonus NAB Rewards Points after meeting the minimum spend requirement within the first 90 days.

5. What is the interest rate on purchases?

The standard purchase interest rate is 20.99% p.a. variable.

6. How many interest-free days are available?

You can enjoy up to 44 interest-free days on purchases when you pay your full statement balance by the due date.

7. What insurance coverage is included?

The card includes comprehensive coverage such as international and domestic travel insurance, car rental excess insurance, mobile phone insurance, and extended warranty protection.

8. Can I add an additional cardholder?

Yes, you can add one additional cardholder at no extra cost.

9. How long does approval take?

Many applicants receive a decision within minutes, but NAB may request additional documentation in some cases.

10. Who should consider this card?

This card is best for customers who:

- Spend frequently and can reach the AUD 5,000 monthly spend target.

- Want to earn NAB Rewards Points and redeem them for travel, shopping, or partner programs.

- Value premium benefits such as insurance and no international transaction fees.

Conteúdo criado com auxílio de Inteligência Artificial