A Complete Guide to Eligibility, Application Steps, and Approval Process

Applying for the Chase Sapphire Reserve® is a major step for anyone seeking a premium rewards credit card in the United States. This guide explains, in detail, how to apply through the official Chase website or mobile app, the basic requirements, and what to expect during the approval process.

Anúncios

Chase Sapphire Reserve

USA – STEP-BY-STEP TUTORIAL ON HOW TO APPLY FOR THE CHASE FREEDOM UNLIMITED® CREDIT CARD

If you want to apply for the Chase Freedom Unlimited® credit card in the United States, follow this practical and easy-to-understand guide.

Here, you’ll learn how to access the official Chase website, explore available credit card options, and correctly complete the online application form.

This tutorial is designed for those seeking clear, reliable information with relevant keywords such as Chase Freedom Unlimited credit card, how to apply for a Chase card, and credit cards in the USA.

Anúncios

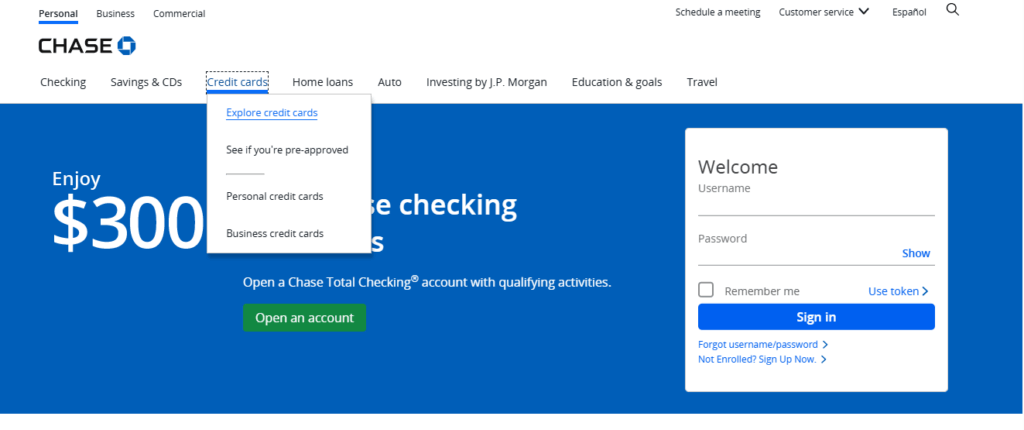

1 – Access the Chase Bank Homepage

Start by visiting the official website: https://www.chase.com/

On the top navigation menu:

- Click the third option, “Credit Cards.”

- Then select the first option, “Explore Credit Cards,” to view all available cards.

This is the main section where you can explore all Chase credit cards, each offering unique benefits for travel, shopping, and cash rewards.

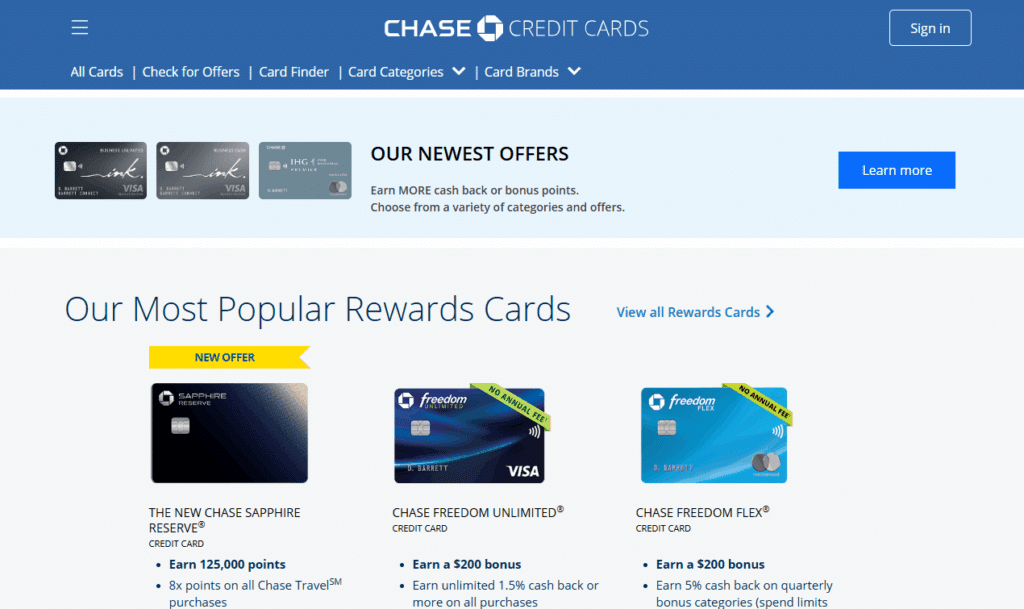

2 – Explore the Available Credit Cards

On the next page, Chase displays a complete list of its most popular credit cards, including:

- Chase Freedom Flex®

- The New Chase Sapphire Reserve®

- Chase Sapphire Preferred®

- IHG One Rewards Premier®

- The New United℠ Explorer Card

This section allows you to compare rewards, annual fees, and exclusive benefits, helping you choose the card that best fits your financial needs.

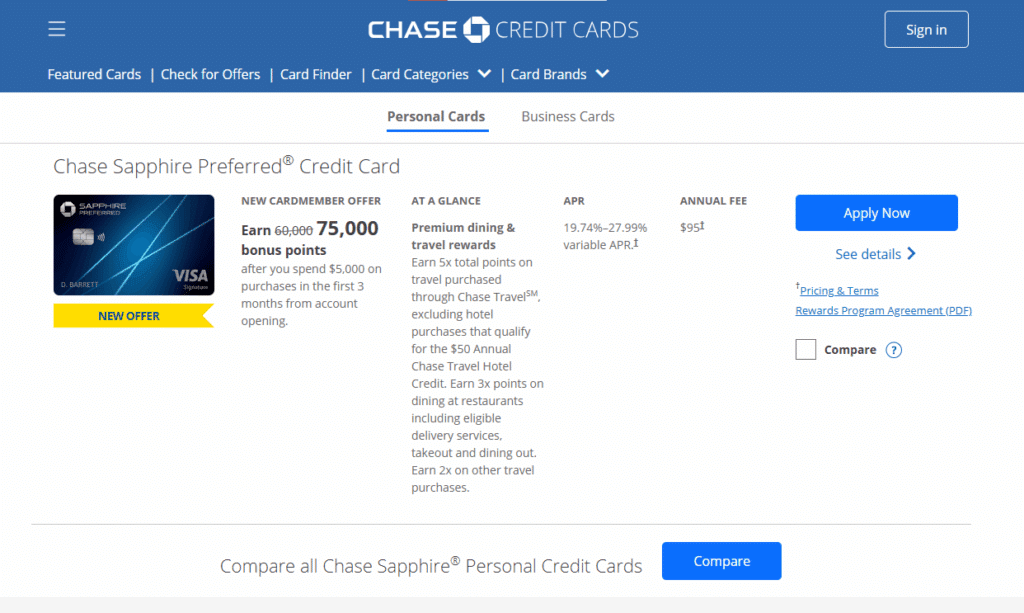

3 – Choose the Chase Sapphire Preferred®

In the list, locate the Chase Sapphire Preferred®, usually appearing as the second option on the page.

Click the card to open the details page, where you can review:

- The Chase Ultimate Rewards® program

- Points on travel, dining, and purchases

- No foreign transaction fees, ideal for frequent travelers

- Bonus offers and welcome rewards

After reviewing, click the blue “Apply Now” button to begin your online application.

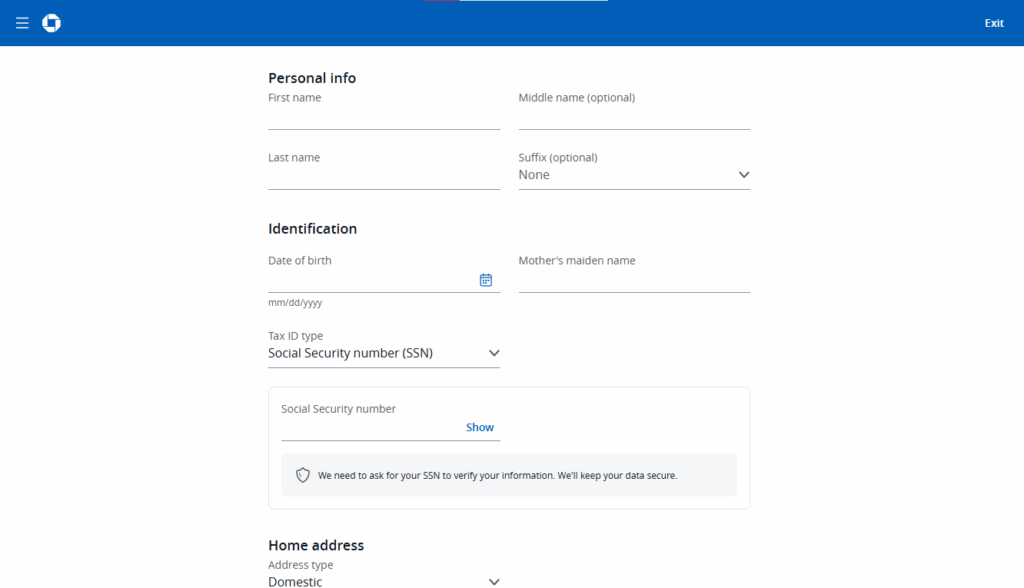

4 – Fill Out the Application Form

You’ll be redirected to the official Chase Sapphire Preferred® application form.

At this stage, you’ll need to provide:

- Personal details: Full name, date of birth, and marital status

- Identification: Social Security Number (SSN) or ITIN

- Residential and mailing address

- Contact information: Phone number and valid email address

- Financial details: Annual income and employment information

Once all fields are completed accurately, review your information and click “Submit Application.”

Chase will review your credit information, and in many cases, approval is instant. If additional documentation is required, you’ll receive an email with instructions.

Important Tips to Increase Your Chances of Approval

- Maintain a good credit score (typically 670 FICO or higher).

- Keep your financial information up to date.

- Ensure your address and SSN are accurate on your records.

- Avoid multiple credit card applications within a few months (Chase applies the “5/24 rule”).

Why Choose a Chase Credit Card

Chase credit cards are well-known in the United States for their security, reputation, and rewards programs. Key benefits include:

- Cashback and reward points that never expire as long as your account is open.

- Full access to the Chase Mobile app, allowing you to track spending in real time.

- 24-hour customer service and purchase protection coverage.

- Extra travel, lodging, and transportation perks for cardholders.

Conclusion

By following this step-by-step tutorial, you can safely apply for your Chase Sapphire Preferred® or Chase Freedom Unlimited® directly from the official website.

Chase credit cards are ideal for those looking for strong rewards, flexibility, and trust in a financial institution with nationwide and digital presence in the U.S.

Everything You Need to Know to Apply for the Chase Sapphire Reserve

Step 1: Check Your Eligibility and Basic Requirements

Before you begin your application, make sure you meet the primary requirements. Chase does not publicly list every detail, but based on official terms and market standards, here’s what you should have:

- You must be a U.S. citizen or permanent resident with a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- You must be at least 18 years old to apply.

- You should have good to excellent credit — most successful applicants have a credit score of 740 or higher.

- You must have a stable source of income, which you will be asked to report during the application.

- You need a residential address in the United States (P.O. boxes are not accepted).

- You must meet Chase’s Sapphire eligibility rule: you cannot currently hold any Sapphire-branded card, and you must not have received a new cardmember bonus from any Sapphire card in the past 48 months.

These conditions are meant to prevent duplicate applications and to ensure that applicants meet Chase’s premium credit standards. Final approval depends on the bank’s internal review.

Step 2: Access the Chase Website or Mobile App

- Go to the Chase website and open the page for the Sapphire Reserve card.

- Click “Apply Now” to start your online application.

- Fill in the application form with your:

- Full name, address, and date of birth

- SSN or ITIN

- Annual income and employment details

- Email address and phone number

During this stage, Chase may offer a pre-qualification check that does not impact your credit score. It’s not a guarantee of approval, but it helps you gauge your likelihood of success.

Step 3: Submit and Wait for Chase’s Decision

After you submit your application, Chase will review your credit profile and financial information. There are two possible outcomes:

- Instant approval: You’ll get an immediate decision if your profile meets the requirements.

- Pending review: If additional verification is needed, Chase may take up to 30 days to issue a final response.

You’ll be notified by email or mail of your application status. If approved, you’ll receive your physical card at your U.S. address within a few business days.

Step 4: Activate and Start Using Your Card

Once you receive your card, you can activate it online or through the Chase mobile app.

You’ll then gain access to the full range of Sapphire Reserve benefits, including:

- Annual travel credit: up to $300 automatically applied to eligible travel purchases each year.

- Airport lounge access: complimentary Priority Pass Select membership, covering over 1,300 lounges worldwide.

- Global Entry / TSA PreCheck / NEXUS fee credit: up to $100 every four years.

- Bonus points on travel and dining: earn 3x points on these categories, and 10x points on select purchases through the Chase Travel portal.

- 50% more value on travel redemptions: when you use points through Chase Ultimate Rewards for flights, hotels, and car rentals.

- Comprehensive travel insurance: including trip cancellation, delay coverage, and lost luggage protection.

- Purchase protection and extended warranty: coverage for eligible items purchased with your card.

Remember that this is a premium card with an annual fee. The key to maximizing value is to use the benefits — especially travel credits and lounge access — to offset the cost.

Overview of Chase Bank: Credibility and Market Presence

To understand why the Sapphire Reserve is one of the most trusted premium cards in the U.S., it helps to look at the institution behind it — JPMorgan Chase & Co.

Chase Bank

About Chase Bank

Chase is one of the largest and most respected banks in the United States. It operates under JPMorgan Chase & Co., a global financial leader offering retail banking, credit cards, investments, loans, and wealth management services.

Chase is a member of the FDIC, meaning eligible deposits are insured by the federal government. The bank serves millions of customers nationwide through a vast network of physical branches, ATMs, and digital banking services.

Chase’s Reputation and Reliability

Chase has built a strong reputation for transparency, digital security, and customer service. Cardholders benefit from:

- 24/7 customer support for Sapphire products.

- Advanced fraud monitoring and account protection.

- User-friendly online and mobile banking tools for tracking spending, paying balances, and redeeming rewards.

The Sapphire line — which includes both the Preferred and Reserve versions — is designed for high-spending individuals who value luxury travel perks, flexible rewards, and premium service.

Chase’s position in the credit card market is solid, competing directly with American Express Platinum and Capital One Venture X in the premium travel segment.

Why Chase Is Trusted for Premium Credit Cards

- Financial stability: As part of JPMorgan Chase, the bank maintains one of the strongest credit ratings among U.S. institutions.

- Transparency: Clear disclosure of rates, fees, and rewards.

- Reward value: The Ultimate Rewards program is considered one of the most flexible and rewarding systems available today.

- Customer experience: Consistent recognition for reliability and security.

When you apply for the Chase Sapphire Reserve, you’re engaging with a bank that has a long history of excellence and innovation in credit and rewards products.

FAQ – Chase Sapphire Reserve Application

1. Can non-U.S. citizens apply for the card?

You typically need an SSN or ITIN to apply. Without one, your application will likely be declined.

2. What credit score do I need for approval?

There is no official minimum, but applicants with a FICO score of 740 or higher generally have better chances of approval.

3. Can I apply if I already have the Chase Sapphire Preferred card?

Yes, you can hold both cards under the updated 2025 policy. However, you may not be eligible for a new cardmember bonus if you’ve recently received one from another Sapphire card.

4. Can I get the Sapphire Reserve bonus if I’ve had the card before?

You’re not eligible for a new-member bonus if you’ve already received one for any Sapphire card in the past 48 months.

5. How long does the approval process take?

Many applicants receive instant decisions. Others may wait up to 30 days if additional verification is required.

6. How do I activate the card after approval?

You can activate it online or through the Chase mobile app once it arrives at your registered address.

7. What are the annual fees for the Sapphire Reserve?

It’s a premium card with a high annual fee. The exact amount is displayed on the application page and may vary by year.

8. What benefits come with the card?

Major benefits include a $300 annual travel credit, Global Entry fee credit, Priority Pass lounge access, insurance protections, and enhanced point redemption through Chase Ultimate Rewards.

9. Can I be denied even if I meet the requirements?

Yes. Approval depends on Chase’s internal credit assessment and overall financial review.

10. What should I do if I’m denied?

Review your credit report for errors, reduce outstanding debts, and consider reapplying after improving your credit profile.

Final Thoughts

The Chase Sapphire Reserve remains one of the top premium travel credit cards in the United States. It offers valuable travel benefits, flexible point redemption, and elite perks that justify its cost — but it’s designed for applicants with strong credit and financial stability.

By following the steps outlined in this guide, you can confidently navigate the Chase application process and make the most of what this elite card has to offer.

Conteúdo criado com auxílio de Inteligência Artificial