If you’re looking for a credit card that rewards your everyday spending, the Blue Cash Preferred® Card from American Express is one of the best cashback cards in the United States.

This tutorial provides a step-by-step guide on how to apply for it, including how to navigate the official American Express website, review card benefits, and complete the application process correctly.

Blue Cash

The American Express Blue Cash Preferred® Card is one of the most popular cash-back credit cards in the U.S., ideal for everyday expenses like groceries, streaming subscriptions, and transportation. If you’re considering applying, this guide explains each step of the process — from eligibility requirements to how to apply online or through the American Express mobile app.

Anúncios

USA – STEP-BY-STEP GUIDE ON HOW TO APPLY FOR THE BLUE CASH CARD FROM AMERICAN EXPRESS

If you’re looking for a credit card that offers valuable cashback rewards for everyday purchases, the Blue Cash Card from American Express is an excellent choice for U.S. consumers.

Follow this detailed step-by-step guide to learn how to apply for your Blue Cash Credit Card directly through the official American Express website.

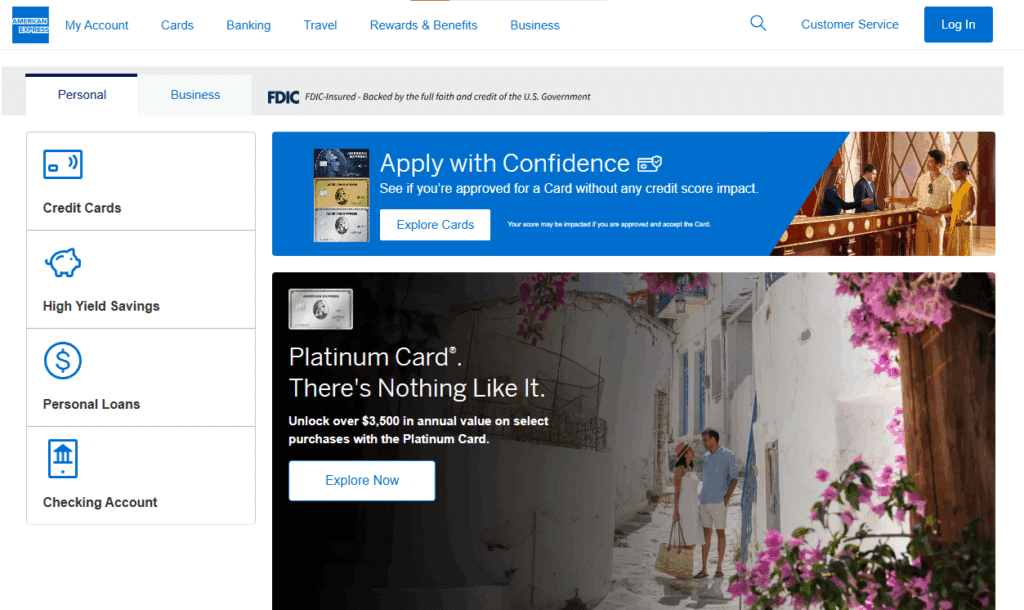

1 – Access the American Express Homepage

Visit the official American Express website at https://www.americanexpress.com/.

On the homepage, click on the first icon under the “Credit Cards” column, located on the left-hand side of the page.

Anúncios

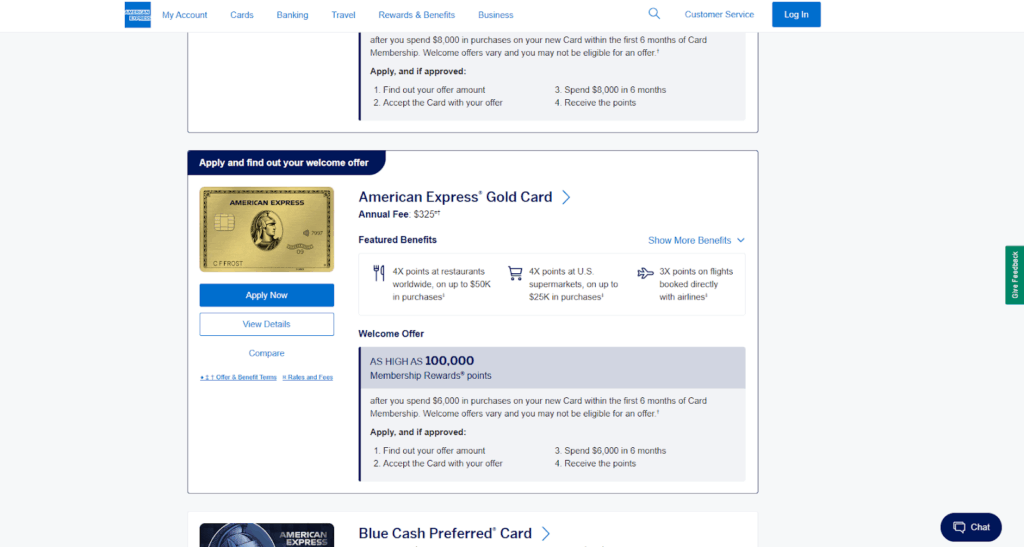

2 – Explore the Available Credit Cards

Once on the credit card page, you’ll find several American Express card options, including:

- American Express® Gold Card

- Blue Cash Preferred® Card

- Blue Cash Everyday® Card

Select the third option — Blue Cash Card to continue with your application process.

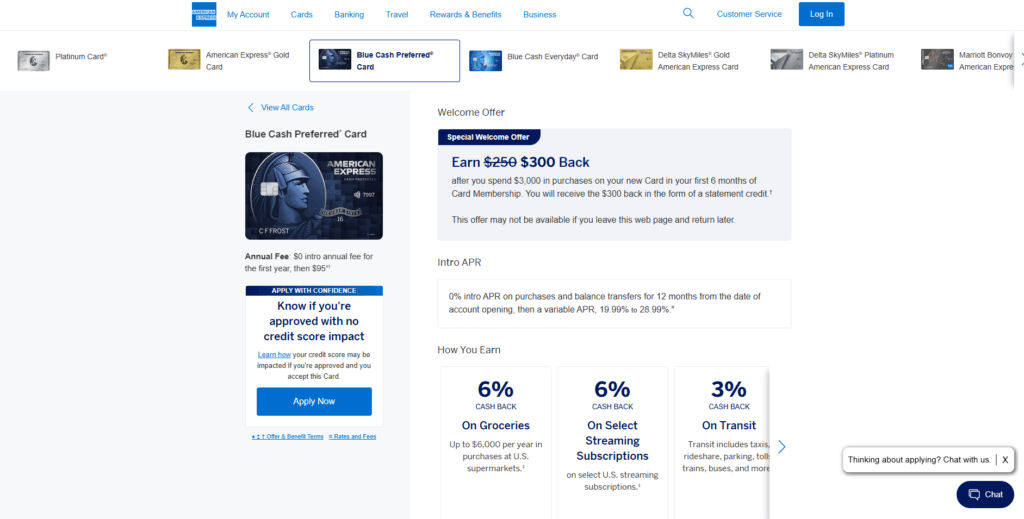

3 – Review the Blue Cash Card Information

On this page, you’ll see all the details about the Blue Cash Card, including cashback categories, fees, and benefits.

To start your application, simply click the blue “Apply Now” button.

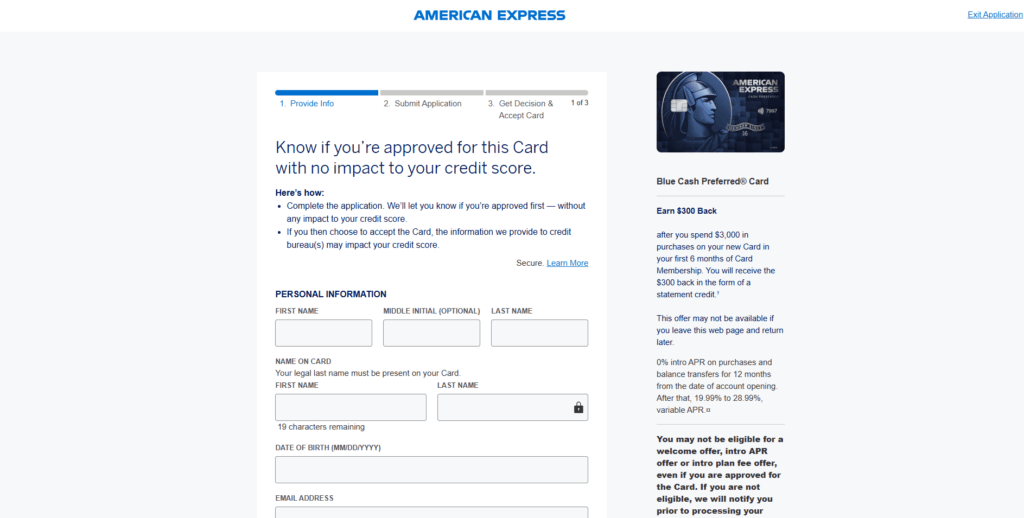

4 – Complete the Application Form

After clicking “Apply Now,” you’ll be redirected to the American Express application form.

The process includes three main steps:

- Provide Info – Enter your personal and financial details, such as:

- Full name, date of birth, and Social Security Number (SSN)

- Residential address and contact information

- Employment and annual income details

- Submit Application – Review your information carefully and click “Submit” to send your application for review.

- Get Decision & Accept Card – American Express will process your request and typically provide an approval decision within minutes. If approved, follow the next steps to accept and activate your Blue Cash Card.

Final Notes

Once approved, you can start enjoying cashback rewards on your daily purchases, including supermarket shopping, gas stations, and online subscriptions.

The Blue Cash Card is ideal for users seeking practical benefits and easy savings on essential expenses, backed by the reliability and global reputation of American Express.

Step 1: Accessing the Application Page

To apply, go to the American Express official website and find the Blue Cash Preferred® Card under the “Credit Cards” section. You’ll be guided through the digital application process, which typically takes just a few minutes. You can also apply via the Amex mobile app, available for iOS and Android, by logging in or creating an account.

When applying online, you’ll be prompted to fill out:

- Your full name and contact information

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Employment and income details

- Housing information (own, rent, or other)

Submitting accurate and complete data helps ensure faster processing and a higher likelihood of approval.

Step 2: Basic Requirements to Qualify

American Express considers several factors before approving your card:

- Credit score: A good or excellent score (typically 700+) increases your approval chances.

- Stable income: Applicants must demonstrate the ability to manage monthly payments.

- U.S. residency: You must have a valid U.S. address and a Social Security Number or ITIN.

- Age requirement: You must be at least 18 years old.

Having an existing relationship with American Express (such as a previous account or authorized user status) may also help your application.

Step 3: Submitting and Tracking Your Application

After submitting your form, American Express will perform a credit check and may instantly approve or request additional verification. In most cases, applicants receive a decision within minutes.

If approved, you’ll receive your new Blue Cash Preferred® Card by mail within 7 to 10 business days. You can also track the status of your application through the Amex website or customer service.

Once you receive your card, activate it online or through the Amex app. You can then start earning cash back on eligible purchases immediately.

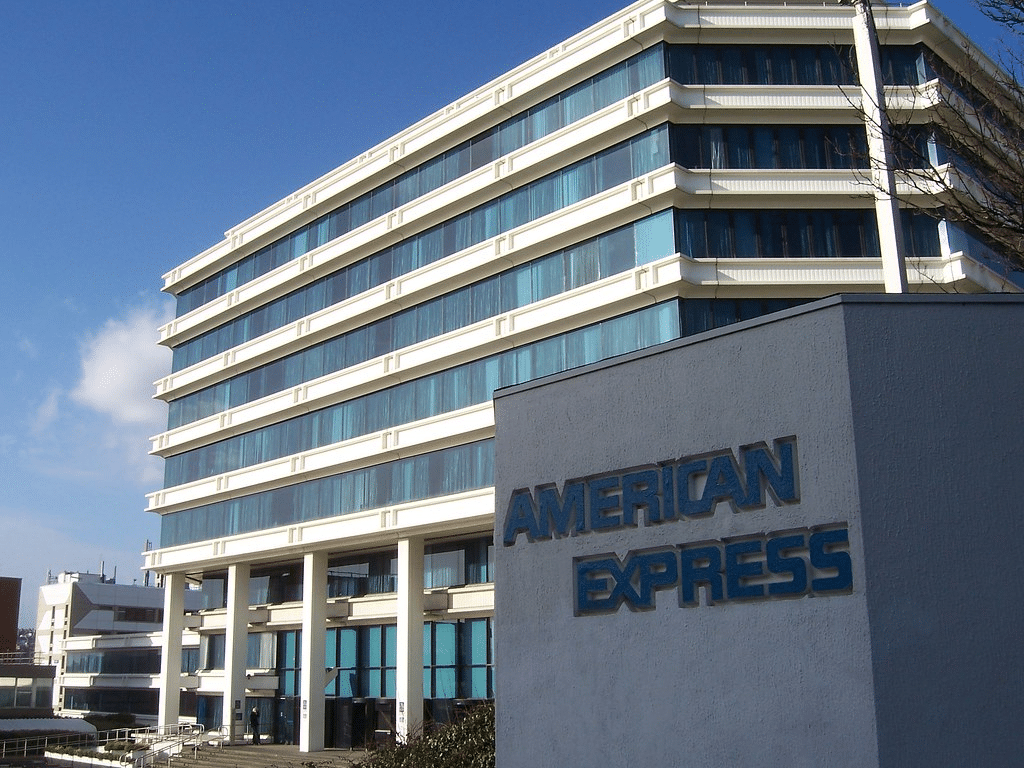

Overview of American Express

American Express (Amex) is one of the most trusted and established financial institutions in the world. Founded in 1850, the company has become synonymous with premium service, global reach, and innovative credit card products.

Headquartered in New York City, American Express operates in more than 130 countries and offers a wide range of financial products — from credit cards and prepaid cards to travel and business services. Its strong reputation for customer service and security has earned it millions of loyal members worldwide.

In the United States, American Express stands out for its reward-based credit cards, which provide exclusive benefits such as cash back, Membership Rewards points, and premium travel perks. The company also emphasizes digital convenience, allowing customers to manage their accounts easily via the Amex app, track spending, and redeem rewards seamlessly.

American Express

The Blue Cash Preferred® Card reflects Amex’s commitment to value and flexibility. Designed for families and individuals who want to maximize their everyday spending, this card offers:

- 6% cash back at U.S. supermarkets (up to an annual spending cap)

- 6% cash back on select U.S. streaming subscriptions

- 3% cash back on transit (including taxis, rideshares, parking, and public transportation)

- 3% cash back at U.S. gas stations

- 1% cash back on other purchases

American Express continues to lead the market in customer satisfaction, innovation, and reward programs — making it a trusted choice for both new and experienced cardholders.

FAQ: Applying for the American Express Blue Cash Preferred® Card

1. What credit score do I need to apply for the Blue Cash Preferred® Card?

Applicants typically need a good to excellent credit score (700 or higher) for approval. However, approval decisions also depend on income, debt-to-income ratio, and credit history.

2. Can I apply if I’m new to credit or recently moved to the U.S.?

Yes, you can apply if you have an SSN or ITIN. However, limited credit history may reduce your approval chances. In such cases, consider starting with a beginner or secured card before applying for premium ones.

3. How long does approval take?

Most applicants receive an instant decision online. In some cases, Amex may require additional verification, which can take a few days.

4. Are there annual fees?

Yes, the Blue Cash Preferred® Card charges an annual fee, but its generous cash-back rewards can easily offset this cost for frequent users.

5. Can I manage my card digitally?

Absolutely. The Amex mobile app lets you track your spending, view statements, make payments, and redeem rewards conveniently from your phone.

6. Is the card accepted internationally?

Yes, American Express is accepted worldwide, but acceptance varies by region. Always check with the merchant when traveling abroad.

Conteúdo criado com auxílio de Inteligência Artificial