This guide walks you through how to apply for the NAB Qantas Rewards Signature Card, including how to access the application, eligibility requirements, costs, benefits, and the approval process — tailored for Australia.

Qantas Rewards Signature

AUSTRALIA – STEP-BY-STEP GUIDE ON HOW TO APPLY FOR THE NAB QANTAS REWARDS SIGNATURE CREDIT CARD

If you live in Australia and want a credit card that earns Qantas Points on everyday purchases, the NAB Qantas Rewards Signature Card is one of the top premium options available.

This easy, step-by-step guide will show you exactly how to apply for the card directly on the official National Australia Bank (NAB) website.

Anúncios

1 – Access the NAB Homepage

Go to the official NAB website: https://www.nab.com.au/

From the homepage, you can navigate through the main menu to find the credit card options.

2 – Navigate to the “Credit Cards” Section

On the top navigation bar, click the second option, labeled “Credit Cards.”

This will take you to the section where NAB lists all its available credit card products.

Anúncios

3 – Explore NAB Credit Card Options

On this page, you’ll find detailed information about several NAB credit cards, such as:

- NAB Low Rate Card (balance transfer offer)

- NAB Low Fee Card

- NAB Qantas Rewards Premium Card, among others.

Select the NAB Qantas Rewards Signature Card, usually the second option in the Qantas category.

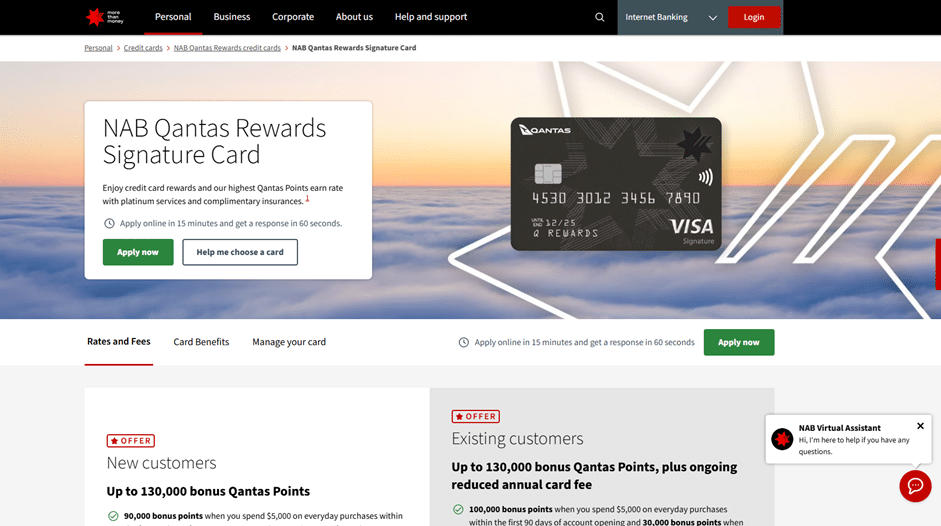

4 – Review the NAB Qantas Rewards Signature Card Details

Once you open the NAB Qantas Rewards Signature Card page, you’ll see complete details about the card, including:

- Earn rates for Qantas Points on eligible purchases

- Bonus points for new applicants who meet the spending criteria

- Annual fee and interest rate information

- Exclusive Qantas travel benefits

Click on the green “Apply Now” button to begin your application.

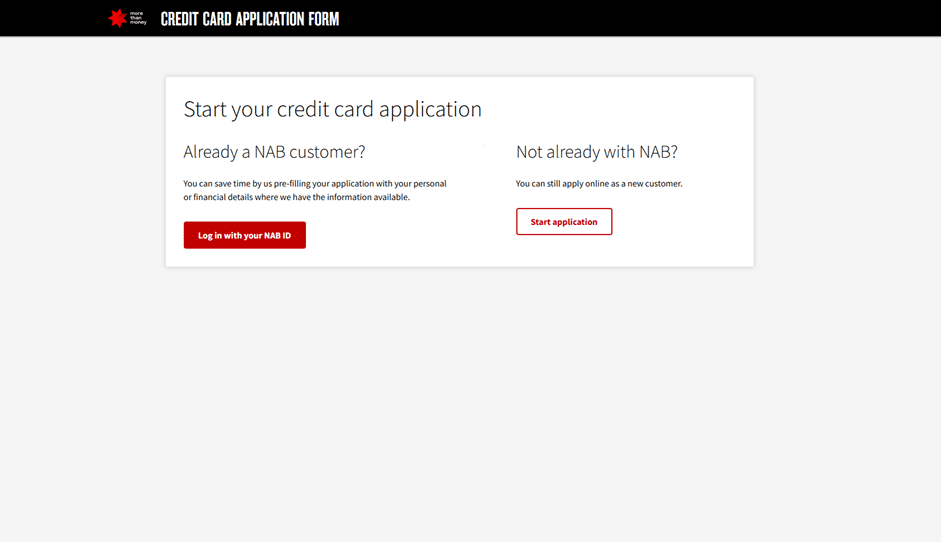

5 – Log In or Start a New Application

After clicking “Apply Now,” you’ll be redirected to the NAB login page.

Here, you’ll see two different paths:

- If you already have a NAB account, simply log in to apply faster using your saved details.

- If you don’t have an account, follow the on-screen instructions to start a new application as a guest.

Once you’ve completed the process, you’ll receive confirmation and updates about your application status. Soon after approval, your NAB Qantas Rewards Signature Card will be mailed to you.

Final Notes

The NAB Qantas Rewards Signature Card combines premium lifestyle features with generous Qantas Points earning potential.

Ideal for frequent travelers and professionals, it offers bonus points, travel insurance, concierge service, and Qantas Club benefits, all under the trusted reputation of National Australia Bank (NAB) — one of Australia’s Big Four banks.

Step 1: Confirm Eligibility & Basic Requirements

Before you apply, be sure you meet the main qualifying criteria. Based on NAB’s published terms, these are essential:

- You must be 18 years or older.

- You must have a regular income.

- You must be a resident for tax purposes in Australia.

- Or be an Australian or New Zealand citizen, an Australian permanent resident, or hold a valid temporary residency visa acceptable to NAB.

- You must have a suitable credit history and financial profile, since this is a premium credit card with a high minimum credit limit.

Meeting these conditions improves your odds of approval, although final approval depends on NAB’s internal credit underwriting — which considers your income, debts, credit history, and other factors.

Step 2: Accessing the Application & Completing It

Here’s how the application process generally works:

- Visit the NAB website and locate the credit cards section, then find the Qantas Rewards Signature variant.

- If you already bank with NAB, log in using your existing online banking credentials to streamline the form. If not, you may apply as a new applicant.

- Fill out the application form, providing details such as:

- Full name, date of birth, address

- Employment status, employer, and income

- Financial obligations and other income sources

- Qantas Frequent Flyer membership number (or you may join as part of application)

- NAB may request supporting documents, such as proof of income or identity verification to complete processing.

Step 3: Costs, Rates & Spending Conditions

Understanding the card’s costs and spending structure is vital:

- The annual fee is AUD 420.

- The card has a minimum credit limit requirement, typically AUD 15,000.

- Purchase interest rate is about 20.99% per annum (variable).

- For balance transfers, the card may offer a 0% rate for 12 months with a transfer fee. After that period, higher variable rates for cash advances apply.

- You typically receive interest-free days on purchases, up to 44 days, as long as you pay your statement balance in full each month.

Step 4: Earning Qantas Points & Bonus Offers

One of the key attractions of this card is its points and bonus structure:

- Bonus Qantas Points: applicants may qualify for up to 130,000 bonus points by spending a certain threshold (e.g. AUD 5,000) in the first 90 days and maintaining the card over 12 months.

- Earning structure on everyday spend:

- 1 Qantas Point per AUD 1 spent for up to AUD 5,000 in eligible purchases in each statement period

- 0.5 Qantas Point per AUD 1 spent on eligible purchases beyond that up to a cap

- Some types of transactions may not qualify for points (such as certain government payments or gambling transactions).

Step 5: Benefits & Additional Features

Besides points, this Signature card offers premium features and protections:

- Travel and purchase insurances, including domestic and international travel cover, extended warranty, and purchase protection

- Vehicle rental excess insurance when you use the card to pay for the rental

- Concierge service, available 24/7 for travel, lifestyle, and personal assistance

- Fraud protection services and emergency card replacement

- You may also get Visa premium benefits and partner discounts

- Free additional cardholder may be included at no extra cost

- Complimentary Qantas Frequent Flyer membership is often included if you are not already a member

Step 6: Approval & Activation Process

- Applications are assessed, and NAB aims to process decisions quickly, especially for online applicants.

- If your application is successful, you will receive the physical card in the mail.

- Activate the card via NAB’s online banking or mobile app.

- To keep the card in good standing, you must pay the annual fee and make at least the minimum repayments by due dates.

Overview of NAB: Credibility & Role in Australian Banking

Understanding the issuer is important when assessing a credit card product.

About NAB

NAB (National Australia Bank) is one of Australia’s “Big Four” banks, with a long history in retail banking, business banking, lending, and financial services. It is heavily regulated and is a major player in Australia’s banking sector.

Reputation & Trust

NAB is subject to oversight by Australian financial regulators and must adhere to strict legal and disclosure requirements. The bank provides detailed information about card terms, fees, rewards, and eligibility to customers.

Its partnership with Qantas Frequent Flyer boosts consumer confidence, since Qantas is a well-known airline loyalty program in Australia and globally.

NAB Bank

Position in the Credit Card Market

- NAB targets premium credit card customers with this Signature offering, competing with other high-end reward and travel cards.

- The Qantas Rewards Signature card is designed for individuals who spend substantially and can make full use of bonus offers and benefits.

- NAB’s digital banking infrastructure (online banking, mobile app), customer support, and fraud protections help bolster its competitiveness in the credit card space.

FAQ – Common Questions About the NAB Qantas Rewards Signature Card

1. Am I eligible to apply?

You must be at least 18, have regular income, be a suitable resident or visa holder in Australia, and meet NAB’s credit standards and minimum credit limit requirement.

2. Can I receive the bonus points if I had a Qantas Rewards card before?

Usually, bonus point offers exclude current or recent cardholders. NAB may require that you haven’t held any personal Qantas Rewards credit card in the past 24 months to qualify.

3. How many Qantas Points do I earn per dollar?

You earn:

- 1 Qantas Point per AUD 1 on eligible purchases up to a set limit

- 0.5 Qantas Point per AUD 1 on further eligible purchases (within defined caps)

4. Is the annual fee high?

Yes — AUD 420 is a significant charge, so you should use the card’s features and bonuses heavily to justify the cost.

5. What are the interest rates?

Purchase interest is around 20.99% p.a. variable. Balance transfers may have promotional rates, but revert to higher variable rates later.

6. How many days interest-free do I get on purchases?

You may get up to 44 days interest-free if you pay your statement balance in full by the due date.

7. What insurances are included?

The card provides various complimentary insurances: travel cover, extended warranty, purchase protection, rental vehicle excess cover, among others. Specific terms and conditions apply.

8. Are there caps on points earning?

Yes. The full points rate applies up to a threshold (e.g. AUD 5,000). Beyond that, the points rate is reduced (e.g. to 0.5 per dollar). Not all purchase types are eligible.

9. What if my application is declined?

You can request information from NAB about the reason. The decline might be due to insufficient income, poor credit history, or failing to meet the minimum credit limit. Improving your credit profile and reapplying later may help.

10. Is this card worthwhile for frequent flyers?

Yes — especially if you fly often with Qantas, spend heavily in everyday categories, and will make use of the bonus points and premium card benefits. But for light spenders, the high fee may outweigh the advantages.

Final Thoughts

The NAB Qantas Rewards Signature Card is tailored for high-spend individuals who want to earn generous Qantas Points, enjoy premium cardholder benefits, and are prepared to pay a substantial annual fee. If your financial profile is strong and you’re committed to leveraging the features, this card can deliver considerable value — particularly if you fly with Qantas regularly or seek to reward your everyday spending.

Conteúdo criado com auxílio de Inteligência Artificial