This section walks you through in a didactic, step-by-step way how to apply for the Delta SkyMiles® Gold American Express Card, from how to access the application, the requirements you’ll need to meet, and what to expect in the approval process.

Delta Skymiles Amex

USA – STEP-BY-STEP GUIDE ON HOW TO APPLY FOR THE DELTA SKYMILES® GOLD AMERICAN EXPRESS CARD

If you’re a frequent traveler looking to earn rewards on Delta flights and everyday purchases, the Delta SkyMiles® Gold American Express Card is an excellent choice.

Below is a simple, step-by-step guide showing exactly how to apply for your card directly on the official American Express website.

Anúncios

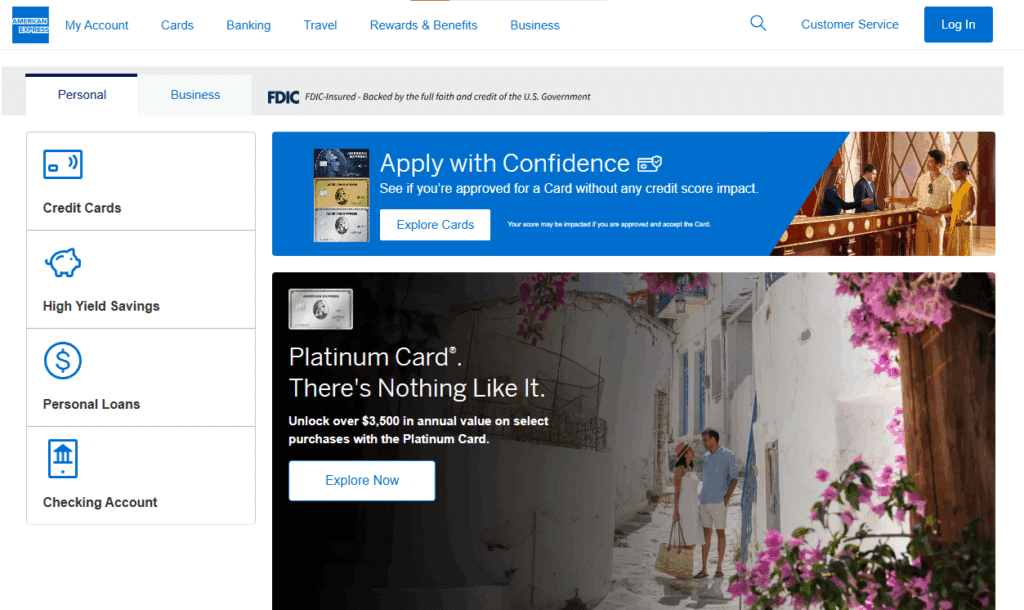

1 – Access the American Express Homepage

Go to the official American Express website at https://www.americanexpress.com/.

On the homepage, click on the first icon under the “Credit Cards” column located on the left-hand side of the screen.

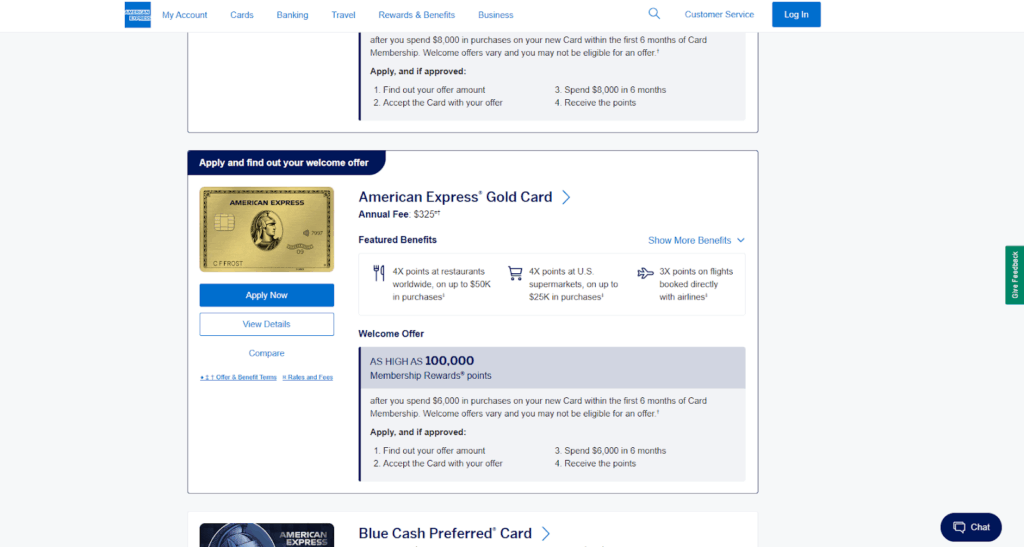

2 – Explore the “Travel” Category

On the next page, you’ll find several credit card options, such as the Gold Card, Blue Cash Preferred, and Blue Cash Everyday.

To locate the Delta card options, click on the “Travel” category (the third option in the main menu).

Then, select the third card on the list — the Delta SkyMiles® Gold American Express Card.

Anúncios

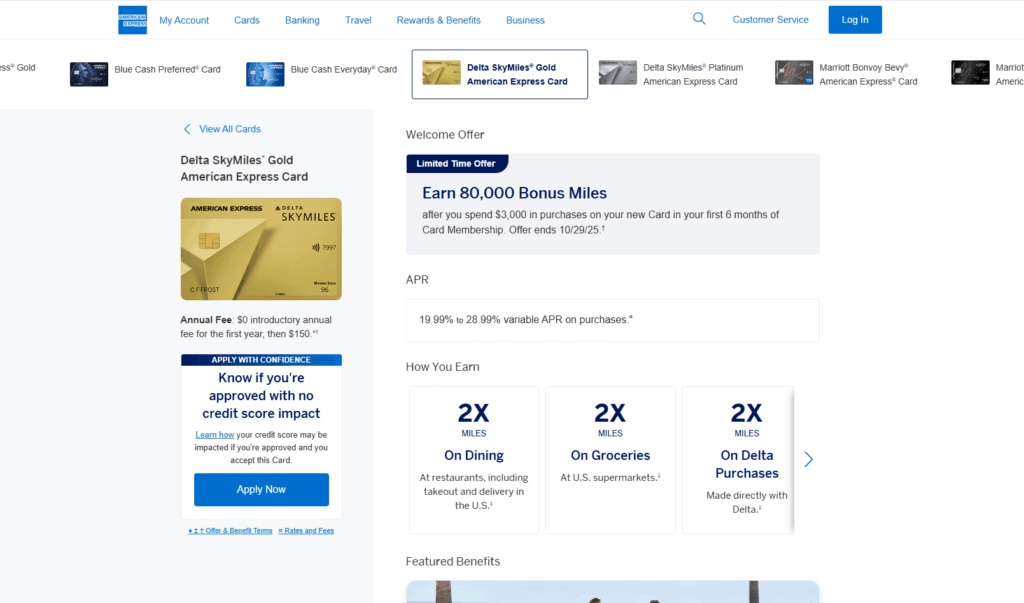

3 – Review the Delta SkyMiles® Gold Card Details

Once on the Delta SkyMiles® Gold page, you’ll see complete information about the card, including:

- Welcome bonus offers

- Mileage earning potential on Delta flights and restaurants

- Annual fee details

- Exclusive Delta travel benefits

To begin your application, click the blue “Apply Now” button.

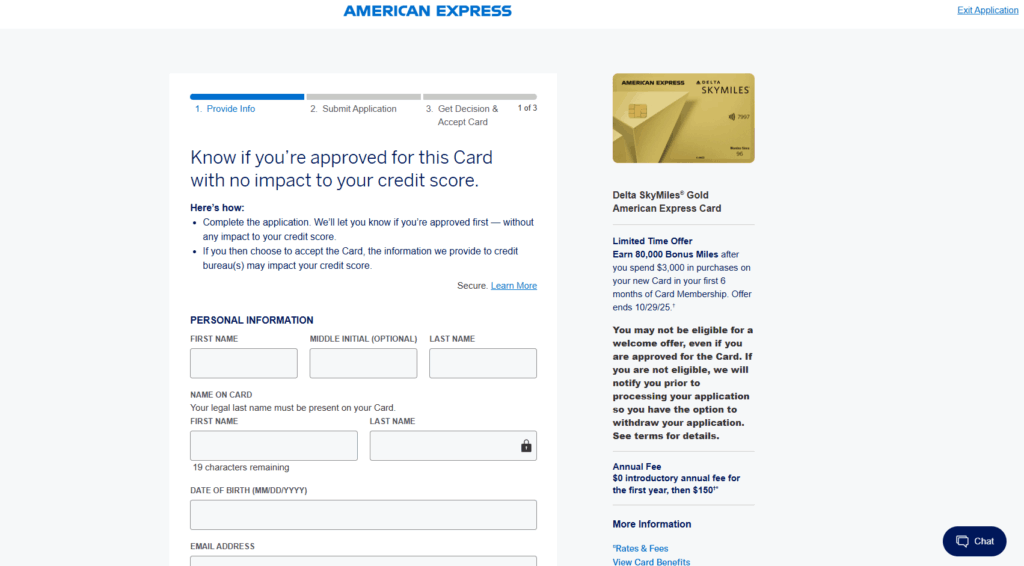

4 – Complete the Online Application Form

After selecting “Apply Now,” you’ll be redirected to the official American Express application form.

The process includes three simple steps:

- Provide Info – Fill out your personal and financial details:

- Full name, date of birth, and Social Security Number (SSN)

- Residential address and contact information

- Employment status and annual income

- Submit Application – Review all entered information carefully and click “Submit.”

- Get Decision & Accept Card – American Express will review your application and provide an approval decision, usually within minutes. If approved, you can proceed to accept and activate your new Delta SkyMiles® Gold American Express Card.

Final Notes

Once approved, you’ll start earning Delta SkyMiles® on every eligible purchase — with extra miles on Delta flight spending, dining, and groceries.

This card is designed for travel enthusiasts who want to enjoy in-flight savings, early boarding, and free checked bags, all backed by the reliability and global service of American Express.

Step 1: Confirm Eligibility & Basic Requirements

Before applying, make sure you satisfy the key conditions. American Express does not disclose all internal criteria, but from the card’s official terms and industry practice, these are important:

- Have a valid U.S. address (physical address; P.O. Boxes may not always be accepted).

- Possess a Social Security Number (SSN) or possibly an Individual Taxpayer Identification Number (ITIN).

- Be 18 years of age or older.

- Demonstrate good to excellent credit history — while no strict minimum is published, many applicants succeed with scores in higher ranges.

- Provide income information so Amex can assess whether you can handle monthly payments.

- Comply with American Express internal eligibility rules, which may include limits on recent credit applications, account history, or existing relationships.

- Be aware of the fees, terms, and benefits of the card so you know what obligations you take on if approved.

Meeting these criteria improves your chance but does not guarantee approval — American Express applies its internal underwriting, considering your credit history, income, existing obligations, and risk profile.

Step 2: Access the Application via the Website or App

- Navigate to the American Express website and locate the Delta SkyMiles Gold Card page under their credit card offerings.

- Click “Apply Now” (or equivalent prompt) to begin your application.

- If you already have an Amex online account, sign in; if not, you may apply as a guest.

- Fill out the application form with required personal and financial information, such as:

- Full legal name, date of birth, U.S. address

- SSN or ITIN

- Employment / occupation, employer or business

- Annual income and additional income sources

- Email, phone number

- Authorization for a credit check

During the application, Amex may offer a prequalification or soft-check tool, letting you see your likely approval chances without hurting your credit. But the full application will require a hard credit inquiry.

Step 3: Submit & Wait for Decision

Once you submit, Amex reviews your credit profile, income, and internal criteria.

- Some applicants receive instant decisions if their information meets the thresholds.

- In other cases, the application may go into “under review / pending”, meaning additional documentation (pay stubs, ID verification, etc.) might be requested.

- You’ll be notified by email or mail of approval, denial, or next steps.

- If approved, the physical Delta SkyMiles Gold Card is mailed to your U.S. address within a few business days.

Step 4: Activate the Card & Use It

After you receive your card, activate it via your American Express online account or mobile app. Upon activation, you can immediately begin using it to make purchases and earn rewards.

Key benefits and features of the Delta SkyMiles Gold Card typically include:

- Welcome / Bonus offer: earn bonus miles after making a required amount of purchases in the first few months

- Earning structure:

- 2× miles on Delta purchases

- 2× miles at restaurants globally

- 2× miles at U.S. supermarkets

- 1× mile on all other eligible purchases

- First checked bag free on Delta flights (for you and up to one companion)

- Priority boarding (Main Cabin 1) on Delta flights

- 25% back on in-flight purchases (food, beverages) on Delta flights

- No foreign transaction fees, making it useful for international travel

- Discounted Delta Sky Club access or other lounge privileges (terms apply)

- Travel protections: baggage insurance, trip delay, car rental loss and damage, purchase protection, etc.

- Annual fee (you should confirm the current dollar amount at time of application)

By leveraging the travel benefits (free checked bag, priority boarding, in-flight discounts) along with miles earned, frequent Delta flyers often find this card particularly valuable.

Overview of American Express: Credibility & U.S. Presence

To understand the issuer’s strength and why the Delta SkyMiles Gold Card is offered through Amex, here’s a look at American Express’s reputation and operations.

American Express

About American Express

American Express is a global financial services company that issues credit cards, charge cards, provides travel and payment services, and manages rewards programs. Unlike many banks that partner with third-party networks, Amex often issues and controls its own cards and network infrastructure.

Reputation, Trust & Strength

- Amex is well known for premium customer service, account security, and fraud protection.

- It provides transparent card terms, listing fees, rewards structures, and benefits clearly.

- The Membership Rewards platform is among the industry leaders, enabling flexibility and strong transfer options to airlines and hotels.

- For co-branded cards (like Delta), Amex’s reputation and stability add trust and credibility for partners and cardholders.

- Its digital infrastructure (web portal and mobile app) is considered among the better ones in the sector, enabling account management, reward tracking, and support.

Role in the U.S. Travel & Co-Brand Card Market

- By issuing Delta co-branded cards, Amex partners with airlines to offer tailored travel benefits and incentives.

- These co-branded cards are vital for frequent flyers who want more value from airline partnerships (e.g. free checked bags, priority boarding).

- Amex allows users to hold multiple card products, enabling stacking of rewards and benefits across travel, cashback, or premium tiers.

- Because of its brand prestige and deep partner integrations, Amex consistently competes at the high end of the credit card market.

FAQ — Common Questions About the Delta SkyMiles Gold Card

1. Do I need to be a U.S. citizen to apply?

No — but you will generally need a valid U.S. address and a Social Security Number (SSN) or ITIN to apply.

2. What credit score is typically required?

While Amex doesn’t publicly state a cutoff, generally you need good to excellent credit (often around 700 or higher) to be competitive. Debt-to-income, credit history, and income stability also count heavily.

3. Can I earn the welcome bonus if I’ve had this card before?

That depends on current Amex terms. Frequently, welcome offers are restricted to new cardholders who have not recently held the same product. Always check the latest terms.

4. How long does it take to receive a decision after applying?

Many applicants get a decision instantly. If additional review is necessary, it may take a few business days or longer in some cases.

5. What is the annual fee?

The card has an annual fee. The exact amount can change, so verify the current fee on the application page.

6. Are there foreign transaction fees?

No. The Delta SkyMiles Gold Card typically does not charge foreign transaction fees, making it useful for travel abroad.

7. What are the main benefits for Delta flyers?

- Free first checked bag for the cardholder and one companion

- Priority boarding (Main Cabin 1)

- 25% back on eligible in-flight purchases (if applicable)

- Ability to earn miles at elevated rates in key categories

8. What kinds of travel protections are included?

You may receive baggage insurance, car rental loss/damage coverage, trip delay / cancellation insurance, purchase protection, and extended warranty on eligible purchases when paid with the card.

9. Can I pair this card with other Amex / Delta cards?

Yes. Many cardholders hold multiple Amex or Delta co-branded cards to optimize earning across travel tiers, bonuses, and credit stacking.

10. What if my application is declined?

You can request reconsideration from Amex, review your credit report for errors, reduce existing debts, improve your credit metrics, and consider reapplying once your profile is stronger.

Conteúdo criado com auxílio de Inteligência Artificial