This section gives a detailed, user-friendly guide showing how to apply for the American Express Platinum Card®, including how to access the application, the basic eligibility requirements, and what to expect in the approval process.

American Express Platinum Card

USA – STEP-BY-STEP GUIDE ON HOW TO APPLY FOR THE PLATINUM CARD® FROM AMERICAN EXPRESS

If you’re considering applying for The Platinum Card® from American Express in the United States, this step-by-step guide will walk you through the entire process. You’ll learn how to navigate the official American Express website, explore available cards, and correctly complete your Platinum Card® application.

Anúncios

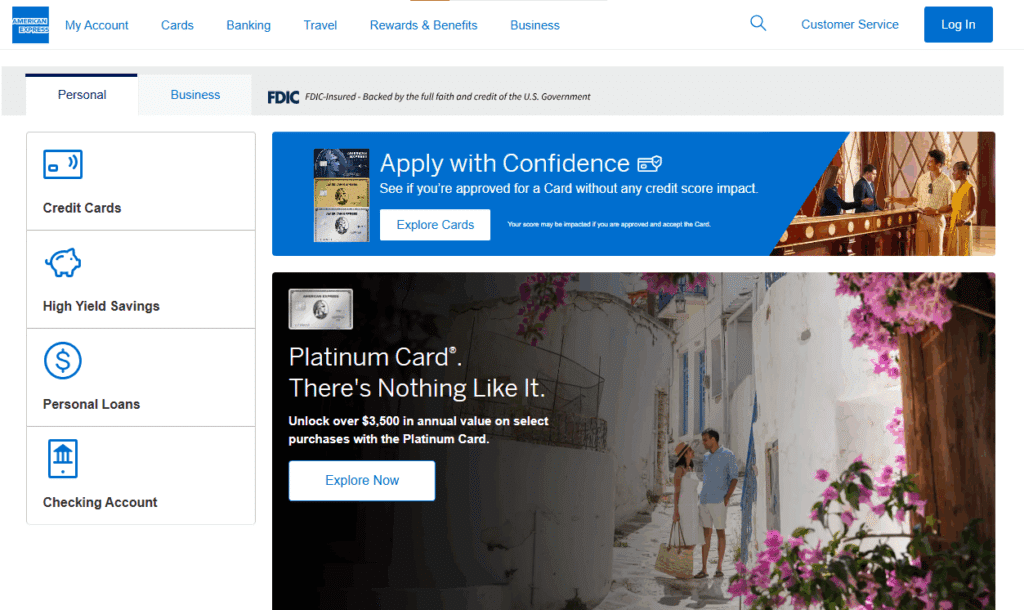

1 – Access the American Express Homepage

Start by visiting the official website: https://www.americanexpress.com/

On the homepage, click the first icon under the “Credit Cards” column, located on the left-hand side of the screen.

Anúncios

This will take you to the main credit card section, where you can view all Amex credit card options, including personal and business cards.

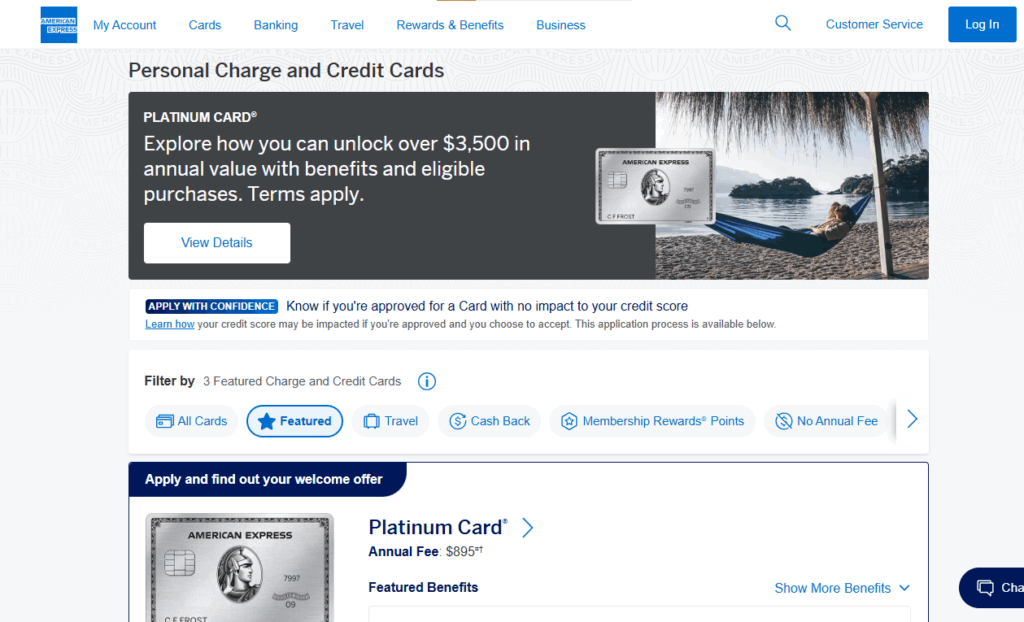

2 – Explore the Available Credit Cards

On the next page, you’ll find a list of American Express credit cards designed for different lifestyles and financial goals. Some of the featured options include:

- American Express® Gold Card

- Blue Cash Preferred® Card

- Blue Cash Everyday® Card

To proceed with the premium version, select the first option — The Platinum Card®.

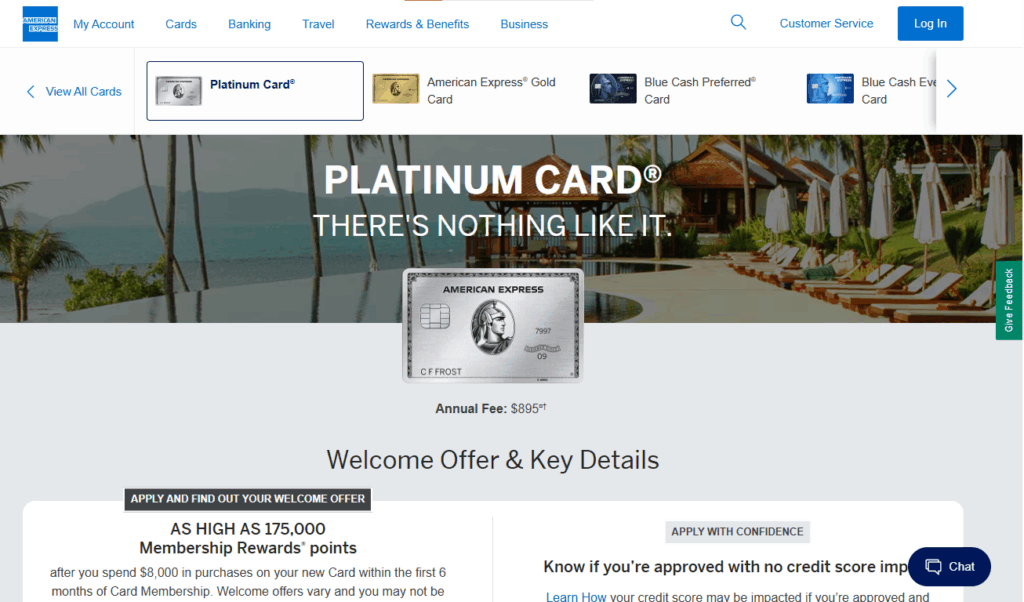

3 – Review the Platinum Card® Details

You’ll now access the official page for The Platinum Card®, where you can explore all its benefits and premium features.

Some key highlights include:

- Extensive travel benefits with access to over 1,400 airport lounges worldwide.

- 5X Membership Rewards® points on flights and hotels booked through Amex Travel.

- Annual statement credits for airline fees, Uber, and digital entertainment.

- No foreign transaction fees, perfect for frequent travelers.

- 24/7 Concierge and Premium Support Services.

Take your time to read all details, compare benefits, and confirm eligibility before applying.

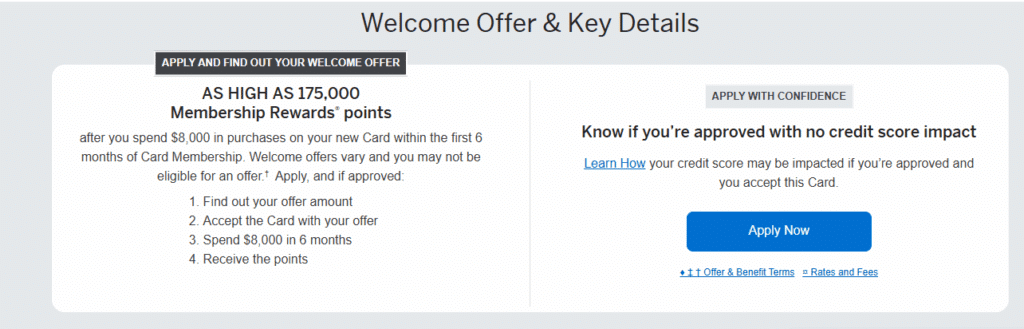

4 – Click “Apply Now”

Once you’re ready to apply, click the blue “Apply Now” button on the Platinum Card® page.

This will direct you to the official American Express application portal.

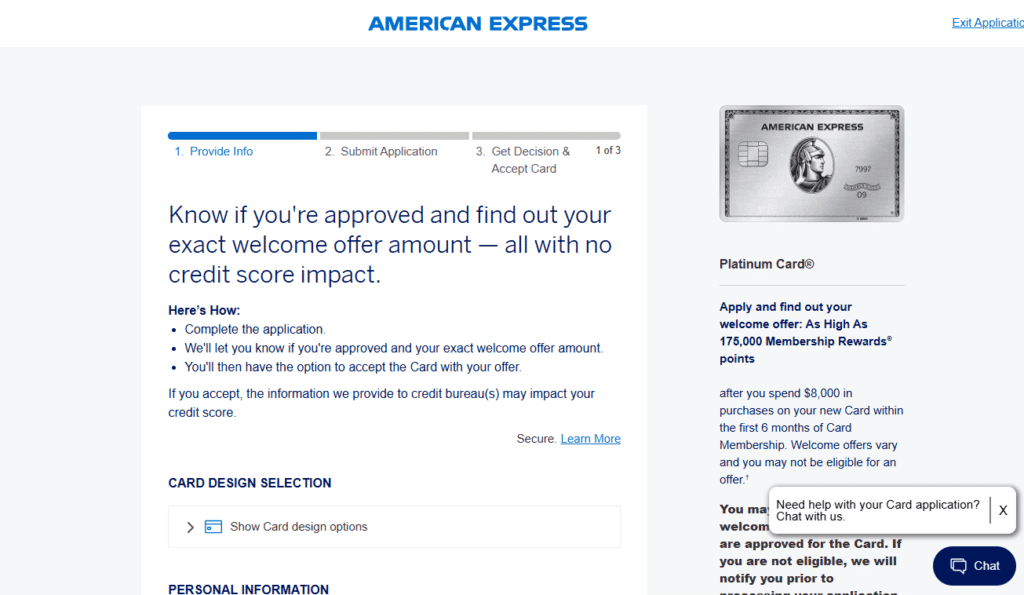

5 – Complete the Application in Three Simple Steps

You’ll be redirected to the American Express application form, divided into three simple stages:

- Provide Info – Enter your personal details such as:

- Full name, date of birth, and contact information

- Residential address

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Annual income and employment status

- Submit Application – After reviewing all your information, submit your form for evaluation.

- Get Decision & Accept Card – If approved, you’ll receive instant confirmation. Follow the instructions to accept your new Platinum Card® and activate your account.

Tips to Improve Your Approval Chances

To strengthen your application and improve approval odds:

- Maintain a strong credit score (700+ FICO) for premium card eligibility.

- Ensure your income and employment details are accurate and verifiable.

- Use a consistent address and SSN/ITIN across your credit records.

- Avoid submitting multiple credit card applications within a short period.

Why Choose The Platinum Card® from American Express

The Platinum Card® is one of the most prestigious credit cards in the U.S., ideal for those who value luxury, travel, and elite service.

Key advantages include:

- Access to airport lounges, hotel upgrades, and exclusive travel partnerships.

- Comprehensive purchase protection and extended warranty coverage.

- Exceptional customer support and premium lifestyle benefits.

- Opportunity to earn rewards faster with 5X Membership Rewards® points on eligible purchases.

Conclusion

By following this step-by-step guide, you can apply for The Platinum Card® from American Express directly on the official website in just a few minutes.

This card is ideal for individuals who seek premium rewards, unmatched travel benefits, and the reliability of one of the most respected financial institutions in the world — American Express.

Step 1: Confirm Eligibility & Basic Requirements

Before you begin the application, make sure you satisfy the primary criteria. American Express does not always publish every internal rule, but from the official benefit pages, terms, and industry analysis, here are the commonly required attributes:

- You must be a U.S. citizen or legal resident with a valid Social Security Number (SSN) or, in some cases, an Individual Taxpayer Identification Number (ITIN).

- You must be at least 18 years old (able to enter into a credit agreement).

- You should have a strong credit history: good to excellent credit is generally expected for this premium card.

- You must have a stable source of income (or assets) that you will report in your application.

- You must have a U.S. billing address (a physical address).

- You cannot currently hold a similar or equivalent American Express Platinum product (depending on internal Amex eligibility rules).

- You should understand that the Platinum Card may have a high annual fee, so your spending pattern, benefits usage, and capacity to manage payments are critical.

Meeting these conditions does not guarantee approval, because American Express uses internal underwriting that considers credit history, debt levels, income, existing credit utilization, and other factors.

Step 2: Access the Application via Website or App

- Go to the official American Express website and navigate to the Platinum Card page (Consumer version).

- On that page, look for “Apply Now” or equivalent.

- If you already have an American Express online account, sign in to streamline the process; if not, you may apply as a guest.

- Fill in the application form with information such as:

- Full legal name, date of birth, and U.S. address

- SSN or ITIN

- Employment or business / source of income

- Annual income (or other income sources)

- Contact information: email and phone number

- Agreement to check your credit (hard inquiry)

During the application, Amex sometimes offers a pre-qualification or pre-approval tool so you can see whether you are likely to be accepted without a hard credit pull. But when you submit the full application, a hard inquiry will typically be performed.

Step 3: Submit & Wait for Decision

- Once you submit your application, American Express will review your credit profile, financial data, and internal criteria.

- In many cases, applicants receive an instant decision if everything is in order.

- In other cases, Amex may place the application “under review,” requesting further documentation or verification, which can take several days.

- You will be notified by email or postal mail of approval, denial, or that additional steps are required.

- If approved, the physical Platinum Card will be shipped to your address, usually within a few business days.

Step 4: Activate the Card & Start Using It

After receiving the card, you will activate it via your online Amex account or via the mobile app. Once active, you can begin to use it immediately.

As a cardholder, you’ll gain access to a broad suite of premium benefits, including:

- Travel credits and statement credits (airline incidental fees, hotel credits, etc.)

- Airport lounge access through the American Express Global Lounge Collection, including Centurion Lounges and other partner lounges.

- Elite status with hotel and car rental partners (e.g., Marriott Gold, Hilton Gold, car rental elite status)

- 5x Membership Rewards points on flights booked directly or via Amex Travel, and on prepaid hotels booked via Amex Travel (subject to caps)

- Credits for Global Entry or TSA PreCheck (fee credits every few years)

- Travel insurance, trip cancellation/interruption coverage, baggage insurance, and other protections when you pay for eligible travel with the card

- “No pre-set spending limit” (i.e., purchases are approved based on the account’s status, history, and resources)

- Access to premium concierge services, purchase protections, rental car loss/damage coverage, and more

The card’s annual fee is high, so you will want to maximize these benefits and credits so that you extract value that exceeds or justifies the cost.

Note: As of 2025, American Express increased the annual fee of the U.S. Platinum Card from $695 to $895 and simultaneously enhanced the benefit package (adding new restaurant credits, wellness credits, etc.). Reuters+2Wall Street Journal+2

Overview of American Express: Credibility & Market Role

Understanding the institution behind the Platinum Card helps prospective applicants appreciate its strength, reliability, and reputation.

American Express

About American Express

American Express (Amex) is a global financial services corporation known especially for its charge cards, credit cards, and travel-related services. It’s a major player in payment processing, card issuing, and loyalty programs. Amex emphasizes premium customer service, exclusive perks, and brand prestige.

Amex operates both consumer and business card divisions. Its cardmembers often expect a high level of benefits, concierge services, and travel perks.

Reputation, Credibility & Strength

- American Express is widely recognized as one of the more premium card issuers, particularly for rewards and travel perks.

- It invests heavily in fraud prevention, account security, and customer support.

- Amex publishes detailed benefit terms, disclosures, and conditions, which adds transparency.

- The Membership Rewards program is a core differentiator: Amex allows you to accumulate points and redeem them across airlines, hotels, transfer partners, or for statement credit, giving flexibility.

- Its lounge network (Centurion, partner lounges) and elite status partnerships often place it among the top-tier travel card issuers.

Role in the U.S. Premium Card Market

- The Platinum Card is one of Amex’s flagship premium products, competing with other high-end cards like the Chase Sapphire Reserve and Capital One Venture X.

- Amex attracts those who travel frequently and can take full advantage of statement credits, lounge access, and elite status.

- Because of its reputation, network of partners, and brand recognition, holding an Amex Platinum often signals a premium, elevated status among credit card users.

FAQ — Common Questions About Applying for Amex Platinum

1. Do I need to be a U.S. citizen to get the Platinum Card?

Not necessarily. What is required is a valid SSN or ITIN, and a U.S. address. Citizenship is not always strict, but many non-citizens lack the identifiers Amex requires.

2. What credit score is needed?

American Express doesn’t publish a fixed cutoff, but you generally need excellent credit. Applicants with strong credit scores, minimal delinquencies, and low credit utilization have a much better chance.

3. Can I hold another Amex card and the Platinum at the same time?

Yes. Many people hold multiple American Express cards (e.g. a rewards or cash-back card alongside Platinum). However, certain benefit stacking and eligibility rules for welcome offers may limit some perks.

4. Can I receive the welcome / new member bonus if I had the Platinum before?

It depends on Amex’s current terms. As is common with premium cards, Amex may restrict eligibility for a new bonus if you’ve had a similar card or received the bonus in recent years. Always check current terms when applying.

5. How long does the approval process take?

Many applicants receive an instant decision. In more complex cases, the application may undergo further review, which can take a few business days.

6. What happens if my application is denied?

You can request a reconsideration with Amex, review your credit reports for errors, reduce outstanding balances, improve your credit profile, and possibly reapply later.

7. When and how do I activate the card once it arrives?

You activate the Platinum Card via your online American Express account or through the Amex mobile app.

8. What is the annual fee and is it worth it?

As of 2025, the annual fee is $895. Because of that, you should plan to use as many of the premium credits and benefits as possible (airline fees, hotel credits, lounge access, dining credits, etc.) to justify the cost.

9. What is “no pre-set spending limit” really mean?

It doesn’t mean infinite spending. Rather, purchases are approved based on internal review of your account, payment history, credit, and financial resources. It provides flexibility but still requires responsible usage.

10. What are key benefits I should activate / enroll in?

Many benefits require enrollment or registration before they take effect — e.g. airline fee credit, hotel credits, lounge access, digital entertainment credits. Be sure to review your benefits dashboard in the Amex app or account and enroll where necessary to avoid missing perks.

Conteúdo criado com auxílio de Inteligência Artificial