Below you’ll find a detailed, didactic guide on how to apply for the the Chase Freedom Flex® credit card, including accessing via website/app, basic requirements, and what to expect during the approval process.

Freedom Flex

USA – STEP-BY-STEP TUTORIAL ON HOW TO APPLY FOR THE CHASE FREEDOM FLEX® CREDIT CARD

If you’re interested in applying for the Chase Freedom Flex® Credit Card in the United States, this guide will walk you through each step clearly and efficiently. You’ll learn how to access the official Chase website, explore available cards, and complete your online application correctly.

Anúncios

This tutorial is SEO-optimized and designed for users searching for information on how to apply for a Chase credit card, Chase Freedom Flex® application process, and best Chase cash-back cards in the USA.

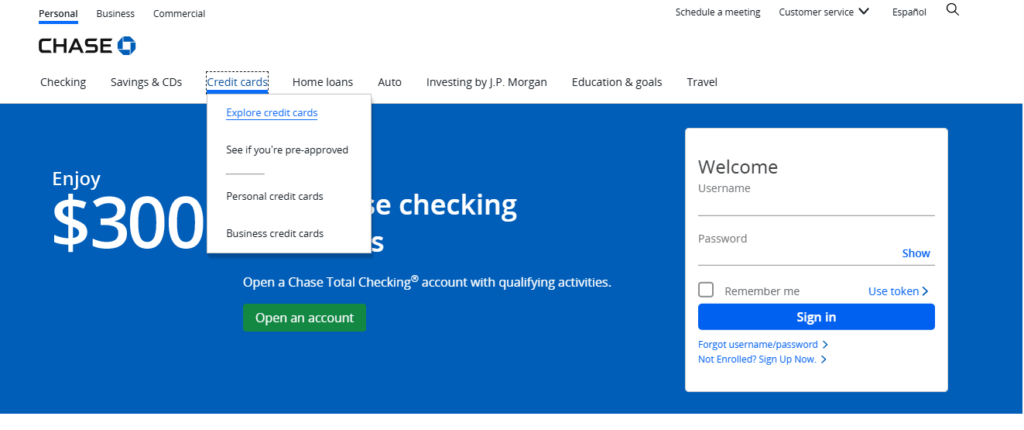

1 – Access the Chase Bank Homepage

Start by visiting the official website: https://www.chase.com/

Anúncios

In the main navigation menu:

- Click on the third option, “Credit Cards.”

- Then select the first option, “Explore Credit Cards.”

This is where you’ll find the complete list of Chase credit cards, allowing you to explore benefits, compare rewards, and select the best card for your needs.

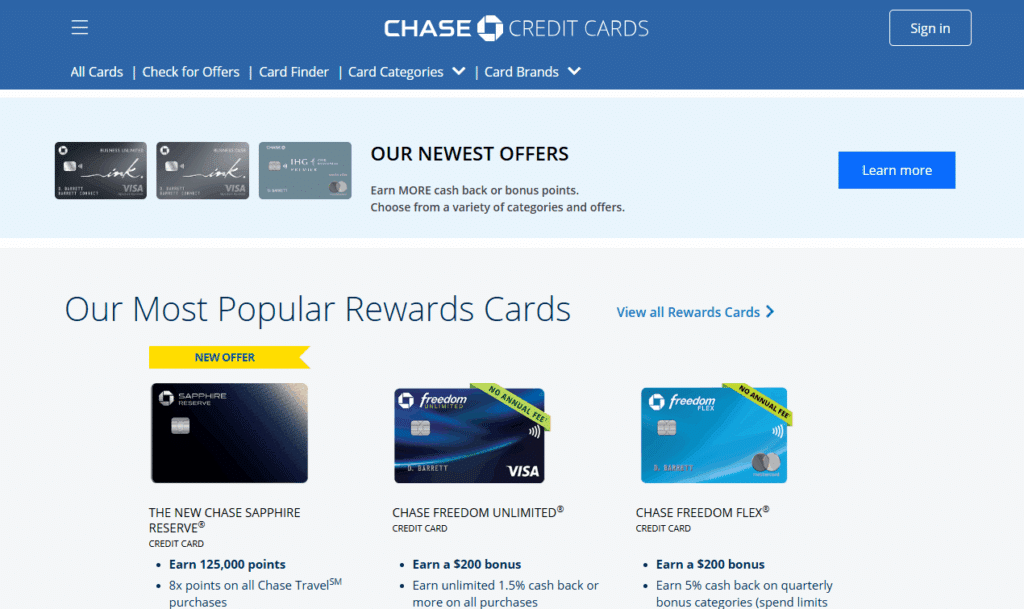

2 – Explore the Available Credit Cards

On the next page, you’ll see a full list of Chase’s most popular credit cards, including:

- Chase Sapphire Preferred®

- The New Chase Sapphire Reserve®

- Chase Freedom Unlimited®

- Chase Freedom Flex®

- IHG One Rewards Premier®

- The New United℠ Explorer Card

Here, you can compare features, benefits, fees, and cashback programs before making your choice.

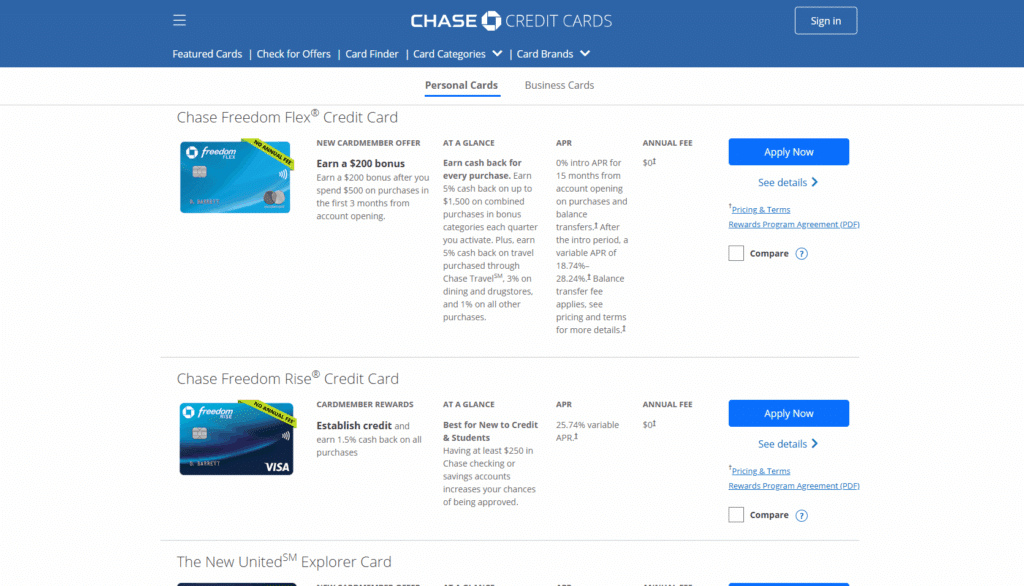

3 – Select the Chase Freedom Flex® Credit Card

From the list of available options, locate the Chase Freedom Flex® Credit Card, typically shown as the fourth card.

Click on it to view the detailed benefits, such as:

- 5% cash back on rotating categories like groceries, travel, and dining.

- 3% cash back on dining and drugstore purchases.

- 1% cash back on all other eligible purchases.

- No annual fee and access to Chase Ultimate Rewards®.

Once you’ve reviewed the information, click the blue “Apply Now” button to start your online application.

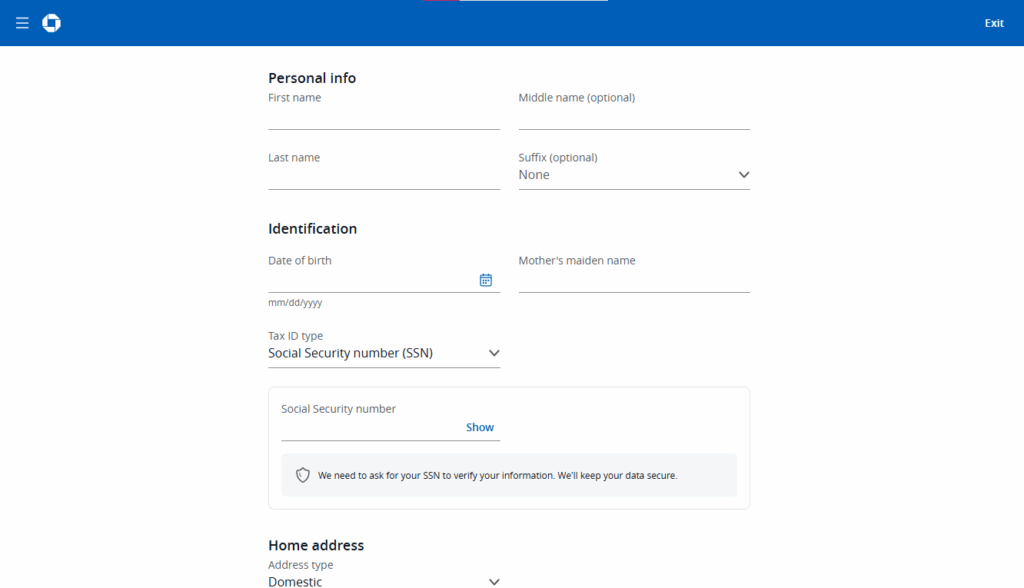

4 – Complete the Application Form

After clicking “Apply Now,” you’ll be redirected to the official Chase Freedom Flex® application form.

You’ll need to fill in the following information:

- Personal details: Full name, date of birth, and marital status.

- Identification: Social Security Number (SSN) or ITIN.

- Address: Residential and mailing address.

- Contact information: Valid phone number and email.

- Financial details: Income and employment information.

Once all fields are completed, review your application and click “Submit.”

Chase will review your credit information, and many applicants receive an instant decision. If additional documents are required, you’ll be contacted by email.

Tips for a Successful Application

To increase your approval chances:

- Maintain a good credit score (670+ FICO).

- Keep your personal and financial information updated.

- Avoid submitting multiple credit card applications within a few months (Chase’s “5/24 Rule” applies).

- Ensure your SSN and address match your current records.

Why Choose the Chase Freedom Flex® Card

The Chase Freedom Flex® stands out among Chase’s credit cards thanks to its flexibility, high cashback rates, and zero annual fee.

Key benefits include:

- Rotating 5% cashback categories that maximize rewards year-round.

- Purchase protection and extended warranty coverage.

- Integration with Chase Mobile App for real-time management.

- Compatibility with PayPal and DoorDash benefits.

Conclusion

By following this step-by-step guide, you can confidently apply for your Chase Freedom Flex® Credit Card through the official Chase website.

It’s an ideal choice for consumers looking for a versatile cashback card that offers both valuable rewards and financial convenience—backed by the trust and reputation of Chase Bank, one of the largest financial institutions in the United States.

Step 1: Confirm Eligibility & Basic Requirements

Before starting an application, ensure you satisfy the key conditions. The issuing bank (Chase) does not publish every internal rule, but based on the card’s official terms and observed practices, the following are critical:

- You must be at least 18 years old (legal adult to enter contract).

- You must have a U.S. mailing address (physical address, not P.O. Box).

- You must have a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- You must report annual income or other sources of income so the bank can assess your ability to pay.

- You should have a credit history of “good” to “excellent” standing. While Chase doesn’t set a strict minimum, many analysts suggest a FICO score in the range of 670 or higher improves your chances. (Sources state you “likely need a good to excellent credit score” for this card)

- You cannot currently hold that card and cannot have received a new-card bonus for the same card in the past 24 months (as per the new cardmember offer eligibility)

- You must not exceed certain internal issuer rules such as Chase’s “5/24 rule” (i.e. opening too many new credit card accounts in a recent period may disqualify you).

These are guidelines; meeting them does not guarantee approval, as Chase applies internal credit risk models, review of credit utilization, debt levels, and other data.

Step 2: Access Chase’s Website or Mobile App & Begin Application

- Go to the official Chase Freedom Flex page (via Chase’s credit card site).

- On the Freedom Flex card page, click “Apply Now” or similar prompt to start the application process.

- If you already have a Chase online account, log in to ease form filling; otherwise, you may apply as a guest.

- Complete the application form with required data:

- Full legal name

- Physical mailing address

- SSN or ITIN

- Date of birth

- Employment status and employer (or business)

- Annual income or other income sources

- Contact info (email, phone)

- Authorization to check your credit (hard inquiry)

During the process, Chase may offer a pre-qualification check (soft credit pull) to indicate your chances without affecting your credit. But full application requires the hard credit inquiry.

Step 3: Submit the Application & Wait for Decision

- After submission, Chase reviews your credit file and financial profile.

- Many applicants receive instant decisions if data is satisfactory.

- In some cases, the application will go into “under review / pending”, meaning Chase may request additional documentation or need more time (sometimes days to weeks).

- You will be notified via email or other contact methods about approval or denial.

- If approved, your physical card is mailed to your U.S. address in a few business days.

Step 4: Activate Card & Begin Use

Once you receive your card, you may activate it via the Chase website or mobile app.

After activation, you can immediately begin using the card and enjoying its cash-back reward structure and benefits, including:

- $0 annual fee — no yearly charge for keeping the card.

- New cardmember bonus: earn a $200 bonus after spending $500 within the first 3 months (if eligible).

- Rewards structure:

- 5% cash back on rotating quarterly bonus categories (after activation, up to $1,500 in combined purchases per quarter)

- 5% cash back on travel purchases made through Chase Travel

- 3% cash back on dining (including delivery/takeout)

- 3% cash back on drugstores

- 1% cash back on all other purchases

- Rewards do not expire while your account is open (and there is no minimum to redeem).

- You can redeem cash back as a statement credit, direct deposit, or convert to points under Chase’s Ultimate Rewards program for more flexibility.

- Additional card protections may apply (purchase protection, etc.).

Maximizing the rotating categories and aligning your spending can help you get the most from the card’s value.

Overview of Chase Bank: Credibility and U.S. Market Role

To properly evaluate a credit card issuer, you must understand the institution behind it — in this case, JPMorgan Chase & Co., operating in consumer banking under the “Chase” brand.

Chase Bank

Who is Chase?

Chase is one of the major national banks in the United States, offering a full suite of banking services: checking accounts, savings, mortgages, loans, investments, credit cards, and wealth management. Its scale is considerable, and it’s widely recognized nationally.

Chase is a member of the FDIC (Federal Deposit Insurance Corporation), meaning eligible customer deposits are insured up to federal limits in case of bank failure.

Reputation, Reliability, and Strength

- Chase is known for robust digital banking infrastructure, including online account management, mobile apps, and integrated credit card systems.

- It invests heavily in fraud detection, account security, and customer support.

- The bank displays transparency in card terms, rewards structures, fees, and eligibility criteria.

- The Chase Ultimate Rewards program is one of its key differentiators, allowing points to be pooled between certain Chase cards to amplify value.

- Because of its history and size, Chase is considered credible, stable, and trustworthy by many consumers and financial institutions.

Role in U.S. Credit Card Market

Chase is among the largest issuers of credit cards in the U.S. It competes in various segments — cash back, travel rewards, business cards. The Freedom line (Flex, Unlimited) is its prominent cash-back offering, often serving as an entry or mid-level card that can synergize with higher-tier Chase cards.

Chase’s broad reach, reliability, and product variety give applicants confidence that they are dealing with a major established institution.

FAQ: Common Questions About Applying for the Chase Freedom Flex

1. Do I need U.S. citizenship to apply?

You generally need a Social Security Number (SSN) or ITIN and a U.S. address; citizenship is not always required, but many non-citizens lack those necessary identifiers.

2. What credit score is required?

Chase does not publicly stipulate a minimum, but many sources state you typically need a good to excellent credit score. Analysts often suggest 670 or higher as a benchmark. (Also, some sources say 700+)

3. Can I apply if I already have a different Freedom card?

Yes. You can hold different Freedom-brand cards (Flex, Unlimited) assuming you meet eligibility and issuer rules. But you might not be eligible for the sign-up bonus if converting or switching existing cards.

4. Can I qualify for the bonus if I’ve had this card before?

No. The new cardmember offer is often excluded if you’ve had the same card and claimed its bonus in the past 24 months.

5. How long until I know the result?

Many applicants receive an instant decision. Some applications may take longer — up to several business days — if additional review is needed.

6. What if my application is denied?

You may be able to request reconsideration with Chase, check your credit reports for errors, reduce debt, improve credit score, and then reapply later.

7. When I get the card, how do I activate it?

You can activate via the Chase website, mobile app, or sometimes by phone as instructed with the card.

8. What is the annual fee?

The Chase Freedom Flex carries no annual fee — it’s $0 per year.

9. What are rotating bonus categories and how do I use them?

Each quarter, a set of merchant categories (gas stations, grocery, etc.) is chosen for 5% cash back. You must activate those categories each quarter to earn 5%. Purchases beyond the $1,500 combined quarterly cap in those categories earn 1%.

10. What is the “5/24 rule” and how does it affect me?

Chase’s 5/24 rule states that if you have opened 5 or more new personal credit cards across any issuers in the past 24 months, Chase may deny further new credit card applications. This rule is commonly cited by credit analysts as a major barrier.

Conteúdo criado com auxílio de Inteligência Artificial