If you’re considering applying for a Chase credit card, such as the Chase Freedom Unlimited, this guide provides everything you need to know — from eligibility requirements and the application process to understanding Chase’s reputation as one of the leading banks in the U.S.

Chase Freedom

Step-by-Step Tutorial on How to Apply for the Chase Freedom Unlimited® Credit Card

Applying for the Chase Freedom Unlimited® Credit Card in the United States is quick and simple when you know each step. This guide will show you exactly how to access the Chase official website, compare available credit cards, and correctly complete the online application form.

Anúncios

Whether you’re new to Chase or an existing customer, this step-by-step tutorial is designed to make the process easy, fast, and stress-free.

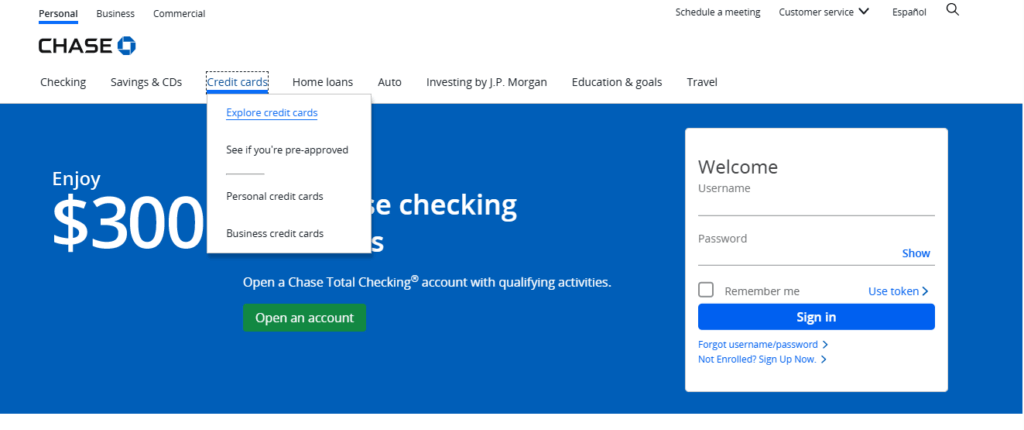

Step 1: Access the Official Chase Homepage

Start by opening the Chase Bank homepage. Once you’re on the site, look for the main menu at the top of the page.

Anúncios

- Click on the third option, “Credit Cards.”

- Then choose “Explore Credit Cards” to view all Chase credit card options.

Here, you’ll enter the section where you can review the full lineup of Chase credit cards available to U.S. residents.

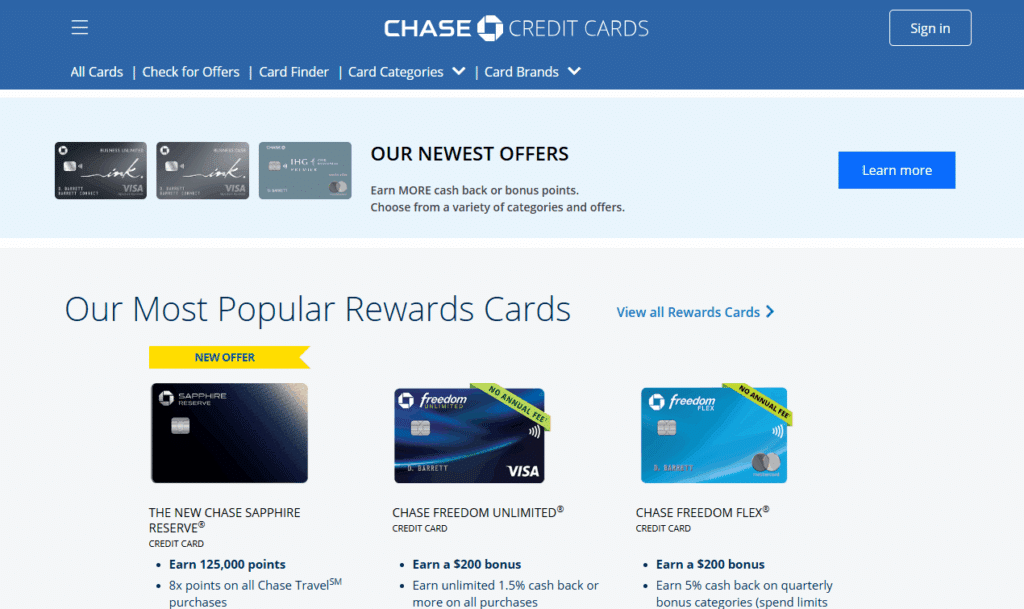

Step 2: Explore Available Chase Credit Cards

On this page, you’ll find detailed information about different Chase credit cards, each designed for specific financial goals. Some of the popular options include:

- Chase Freedom Flex® – Great for rotating bonus categories and no annual fee.

- Chase Sapphire Reserve® – A premium travel card offering luxury rewards.

- Chase Sapphire Preferred® – Ideal for travelers who want high-value points and flexibility.

- IHG One Rewards Premier® – Perfect for frequent hotel guests and loyalty members.

- United℠ Explorer Card – Tailored for travelers who prefer United Airlines benefits.

This section allows you to compare benefits, fees, and rewards, helping you choose the card that fits your lifestyle and spending habits.

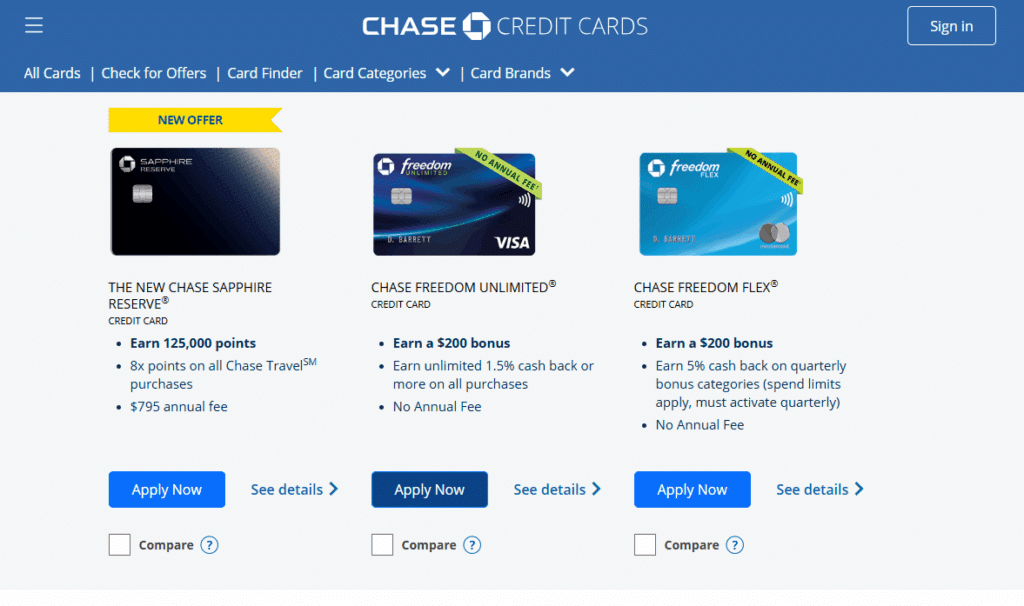

Step 3: Select the Chase Freedom Unlimited®

Scroll through the list until you find Chase Freedom Unlimited®, which typically appears as the second option among the featured cards.

Click on the card name or image to open its detailed information page. There, you’ll see all the benefits, including:

- Unlimited 1.5% cash back on every purchase.

- 5% cash back on travel purchased through Chase Travel.

- 3% on dining and drugstores.

- No annual fee.

- Introductory 0% APR for the first 15 months on purchases and balance transfers.

Once you review the details, click on the blue “Apply Now” button to begin your credit card application.

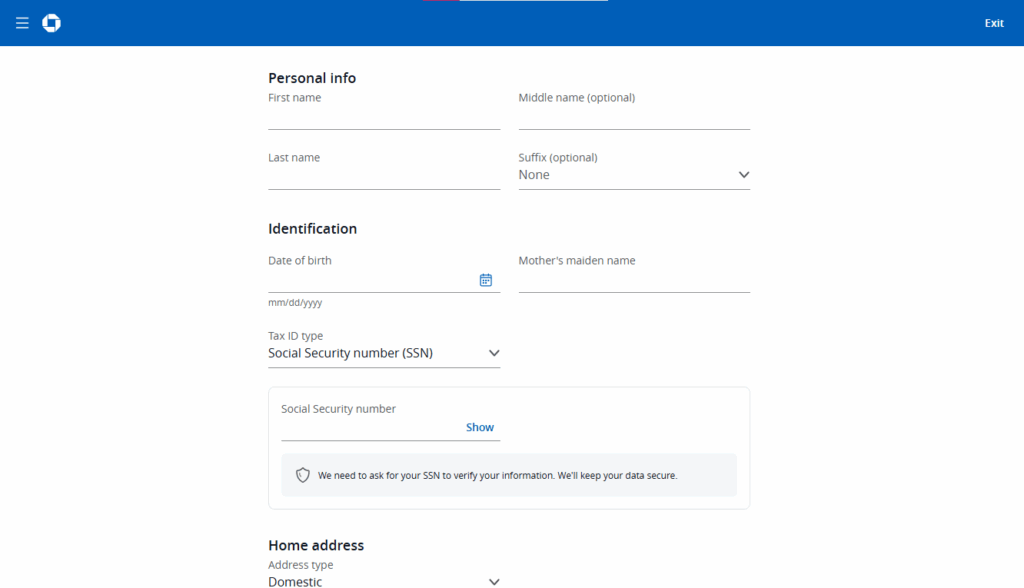

Step 4: Fill Out the Online Application Form

After clicking Apply Now, you’ll be redirected to the secure Chase Freedom Unlimited® application page.

Fill in all required information carefully, including:

- Personal Information: Full name, date of birth, and citizenship status.

- Identification Details: Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Residential Address: Your current home and mailing address.

- Contact Information: Valid phone number and email address.

- Income and Employment: Your current employment status, employer name, and annual income.

Before submitting, review all your details to ensure accuracy. Then, click “Submit Application.”

Once your application is submitted, Chase will review your credit profile and provide an instant decision in many cases. If additional verification is required, you’ll receive instructions via email or your Chase online account.

Everything You Need to Know to Apply for a Chase Credit Card

1. Access the Website or App

To start your application, visit the official Chase credit cards page and locate the card you wish to apply for — for example, the Chase Freedom Unlimited. Click on “Apply Now” to begin.

If you already have a Chase online account, log in to make the process faster. Alternatively, you can use the Chase Mobile App, which allows you to access your existing accounts and sometimes start a new credit card application directly from your phone.

2. Basic Requirements to Apply

Before applying, make sure you meet the Chase eligibility criteria. Generally, you must:

- Be a U.S. resident with a valid residential address.

- Be at least 18 years old.

- Have a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN).

- Provide proof of income or employment information.

- Have a good credit history, since Chase typically approves applicants with a solid credit score.

- Not have received a new customer bonus for the same card within the past 24 months.

Chase also reviews your credit report, debt-to-income ratio, and how you manage existing credit accounts before making a decision.

3. The Application Process and Approval

If you meet the requirements, follow these steps to complete your Chase credit card application:

- Fill out the online application form.

Provide your personal details, including your full name, address, date of birth, SSN or ITIN, and contact information. - Add financial information.

Include your annual income, employment status, and any additional financial data required. Chase uses this to assess your repayment ability and determine your credit limit. - Review terms and conditions.

Carefully read all terms regarding rates, fees, and rewards before submitting the application. - Submit your application.

Once completed, Chase will conduct a credit check (a “hard inquiry”) to evaluate your eligibility. - Approval or decision pending.

In many cases, Chase provides an immediate decision. If more time or documentation is needed, you will receive instructions via email or your online account. - Receiving your card.

If approved, the card will be mailed to your registered address, and you can activate it through the Chase website or mobile app.

4. Key Features of the Chase Freedom Unlimited

The Chase Freedom Unlimited is one of the most popular options for those looking for a flexible and rewarding credit card. Here are its main benefits:

- Unlimited 1.5% cash back on all purchases.

- Bonus categories: 5% on travel purchases made through Chase Travel, 3% on dining (including takeout and delivery), and 3% at drugstores.

- New customer bonus: Earn a $200 cash reward after spending $500 in the first 3 months.

- No annual fee, making it ideal for everyday use.

- Introductory 0% APR for 15 months on purchases and balance transfers, followed by a variable APR ranging from approximately 18.74% to 28.24%.

- Flexible rewards: Cash back is earned as Chase Ultimate Rewards points, which can be redeemed for statement credits, travel, gift cards, or direct deposits.

This card is particularly attractive for users who want consistent rewards without complex rules or annual costs.

Overview of Chase Bank and Its Credibility

History and Structure

Chase Bank operates as part of JPMorgan Chase & Co., one of the world’s largest financial institutions. The bank serves millions of individuals, families, and businesses across the United States, offering services such as checking accounts, mortgages, loans, and credit cards.

Chase Bank

Chase is widely recognized for its financial strength, stability, and innovation in consumer banking.

Presence and Reach

Chase has thousands of branches and ATMs throughout the United States. Its digital ecosystem — including advanced online banking and a robust mobile app — allows customers to manage accounts, make payments, and monitor their credit anytime, anywhere.

The bank is also FDIC insured, meaning eligible deposits are protected, which reinforces consumer confidence and trust.

Trust and Reputation

- Chase is known for financial reliability and transparency.

- The bank offers strong customer support through multiple channels.

- Its credit card division is particularly respected for providing a wide range of cards with competitive rates and robust rewards programs.

Overall, choosing a Chase credit card means joining one of the most trusted and stable financial institutions in the United States.

Frequently Asked Questions (FAQ)

1. What credit score is needed to get approved?

A “good” credit score — typically around 670 or higher — is recommended for approval.

2. Is there a welcome bonus?

Yes. New customers can receive a $200 bonus after spending $500 within the first three months of account opening.

3. Does the card have an annual fee?

No, the Chase Freedom Unlimited has no annual fee.

4. What are the applicable interest rates (APR)?

There is a 0% introductory APR for 15 months on purchases and balance transfers, after which a variable APR applies (approximately 18.74%–28.24%).

5. How can I check the status of my application?

You can monitor your application status through your Chase online account or by contacting the Chase customer service team.

6. What if Chase needs more time to process my request?

If additional verification or documents are needed, you’ll be notified by email or through your Chase account.

7. Can I apply if I already have other credit cards?

Yes, but Chase enforces the “5/24 rule,” meaning applicants who have opened five or more credit cards in the past 24 months may not be approved.

8. Do Chase Ultimate Rewards points expire?

No. As long as your account remains active, your points never expire.

9. Is this card good for travel?

Yes. You earn 5% cash back on travel purchases made through Chase Travel.

10. Can I transfer balances from other cards?

Yes, you can transfer balances and enjoy the 0% APR promotional period, but note that a balance transfer fee may apply.

By following this guide, you can confidently apply for a Chase Freedom Unlimited credit card and enjoy its combination of rewards, flexibility, and trust backed by one of America’s leading banks.

Conteúdo criado com auxílio de Inteligência Artificial